Question: Question 2 and 4 only 2. Microsoft has a beta of 2.0. The annualized market return yesterday was 11%, and the risk-free rate is currently

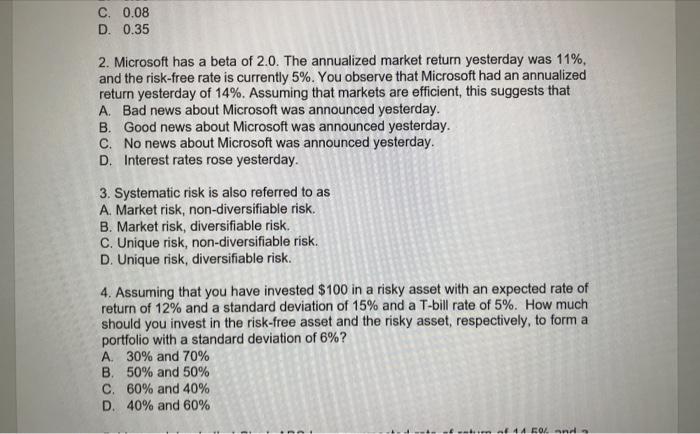

2. Microsoft has a beta of 2.0. The annualized market return yesterday was 11%, and the risk-free rate is currently 5%. You observe that Microsoft had an annualized return yesterday of 14%. Assuming that markets are efficient, this suggests that A. Bad news about Microsoft was announced yesterday. B. Good news about Microsoft was announced yesterday. C. No news about Microsoft was announced yesterday. D. Interest rates rose yesterday. 3. Systematic risk is also referred to as A. Market risk, non-diversifiable risk. B. Market risk, diversifiable risk. C. Unique risk, non-diversifiable risk. D. Unique risk, diversifiable risk. 4. Assuming that you have invested $100 in a risky asset with an expected rate of return of 12% and a standard deviation of 15% and a T-bill rate of 5%. How much should you invest in the risk-free asset and the risky asset, respectively, to form a portfolio with a standard deviation of 6% ? A. 30% and 70% B. 50% and 50% C. 60% and 40% D. 40% and 60%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts