Question: Please show all equations and work as needed. 3. Google has a beta of 1.0. The annualized market return yesterday was l 1%, and the

Please show all equations and work as needed.

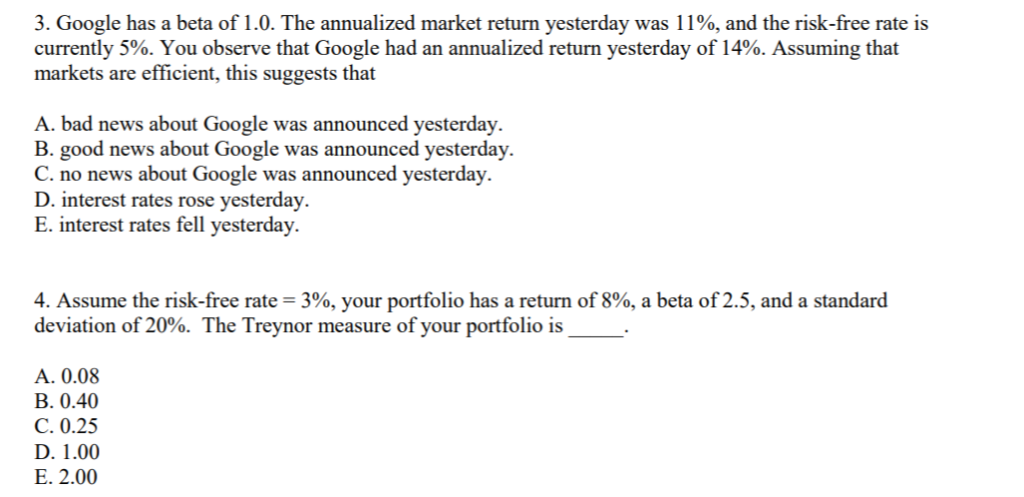

3. Google has a beta of 1.0. The annualized market return yesterday was l 1%, and the risk-free rate is currently 5%. You observe that Google had an annualized return yesterday of 14%. Assuming that markets are efficient, this suggests that A. bad news about Google was announced yesterday B. good news about Google was announced yesterday C. no news about Google was announced yesterday D. interest rates rose yesterday. E. interest rates fell yesterday. 4. Assume the risk-free rate-3%, your portfolio has a return of 8%, a beta of 2.5, and a standard deviation of 20%. The Treynor measure of your portfolio is A. 0.08 B. 0.40 C. 0.25 D. 1.00 E. 2.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts