Question: Question 2 I. An analyst is evaluating two bonds, Bond Q and Bond P. The effective maturity of both bonds is 5 years. The face

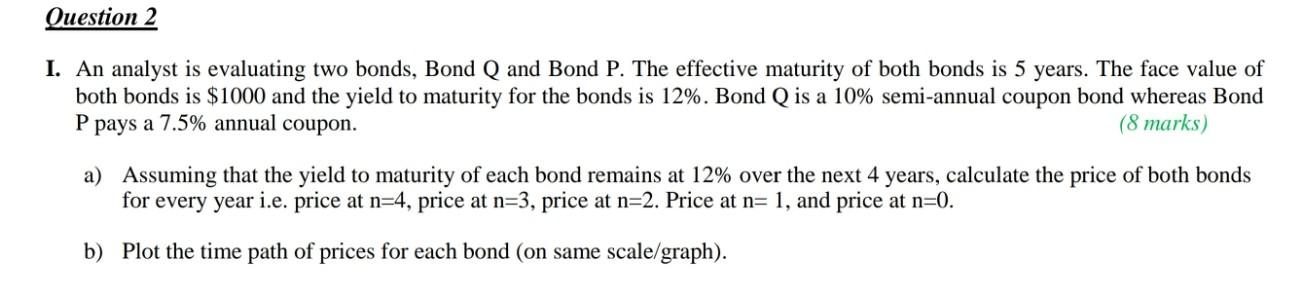

Question 2 I. An analyst is evaluating two bonds, Bond Q and Bond P. The effective maturity of both bonds is 5 years. The face value of both bonds is $1000 and the yield to maturity for the bonds is 12%. Bond Q is a 10% semi-annual coupon bond whereas Bond P pays a 7.5% annual coupon. (8 marks) a) Assuming that the yield to maturity of each bond remains at 12% over the next 4 years, calculate the price of both bonds for every year i.e. price at n=4, price at n=3, price at n=2. Price at n= 1, and price at n=0. b) Plot the time path of prices for each bond (on same scale/graph)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts