Question: On 1 July 2009, Wollongong Ltd acquired a number of assets from Bathurst Ltd. The assets had the following fair values at that date

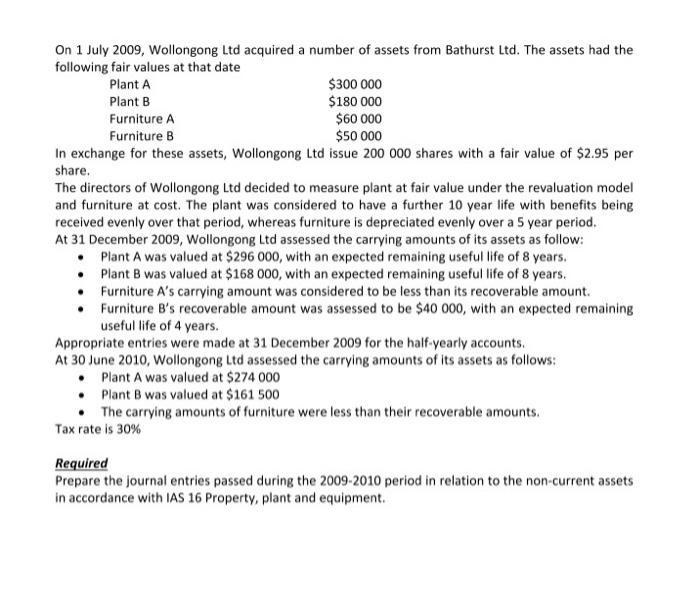

On 1 July 2009, Wollongong Ltd acquired a number of assets from Bathurst Ltd. The assets had the following fair values at that date Plant A Plant B $300 000 $180 000 $60 000 $50 000 Furniture A Furniture B In exchange for these assets, Wollongong Ltd issue 200 000 shares with a fair value of $2.95 per share. The directors of Wollongong Ltd decided to measure plant at fair value under the revaluation model and furniture at cost. The plant was considered to have a further 10 year life with benefits being received evenly over that period, whereas furniture is depreciated evenly over a 5 year period. At 31 December 2009, Wollongong Ltd assessed the carrying amounts of its assets as follow: Plant A was valued at $296 000, with an expected remaining useful life of 8 years. Plant B was valued at $168 000, with an expected remaining useful life of 8 years. Furniture A's carrying amount was considered to be less than its recoverable amount. Furniture B's recoverable amount was assessed to be $40 000, with an expected remaining useful life of 4 years. Appropriate entries were made at 31 December 2009 for the half-yearly accounts. At 30 June 2010, Wollongong Ltd assessed the carrying amounts of its assets as follows: Plant A was valued at $274 000 Plant B was valued at $161 500 The carrying amounts of furniture were less than their recoverable amounts. Tax rate is 30% Required Prepare the journal entries passed during the 2009-2010 period in relation to the non-current assets in accordance with IAS 16 Property, plant and equipment.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

1 July 2009 Dr Noncurrent assets 830 000 Cr Shares 583 500 ... View full answer

Get step-by-step solutions from verified subject matter experts