Question: Mandurah Manufacturing Ltd's post-closing trial balance at 30 June 2010 included the following balances 1 Accumulated depreciation - Fixtures $134 138 The Machinery Control

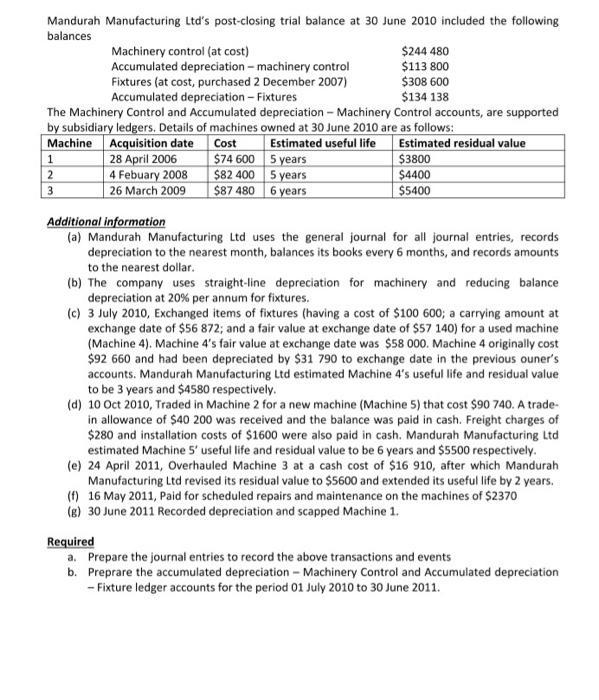

Mandurah Manufacturing Ltd's post-closing trial balance at 30 June 2010 included the following balances 1 Accumulated depreciation - Fixtures $134 138 The Machinery Control and Accumulated depreciation - Machinery Control accounts, are supported by subsidiary ledgers. Details of machines owned at 30 June 2010 are as follows: Machine Cost Estimated useful life Estimated residual value $74 600 5 years Acquisition date 28 April 2006 4 Febuary 2008 26 March 2009 $82 400 5 years $87 480 6 years 2 Machinery control (at cost) Accumulated depreciation - machinery control Fixtures (at cost, purchased 2 December 2007) 3 $244 480 $113 800 $308 600 $3800 $4400 $5400 Additional information (a) Mandurah Manufacturing Ltd uses the general journal for all journal entries, records depreciation to the nearest month, balances its books every 6 months, and records amounts to the nearest dollar. (b) The company uses straight-line depreciation for machinery and reducing balance depreciation at 20% per annum for fixtures. (c) 3 July 2010, Exchanged items of fixtures (having a cost of $100 600; a carrying amount at exchange date of $56 872; and a fair value at exchange date of $57 140) for a used machine (Machine 4). Machine 4's fair value at exchange date was $58 000. Machine 4 originally cost $92 660 and had been depreciated by $31 790 to exchange date in the previous ouner's accounts. Mandurah Manufacturing Ltd estimated Machine 4's useful life and residual value to be 3 years and $4580 respectively. (d) 10 Oct 2010, Traded in Machine 2 for a new machine (Machine 5) that cost $90 740. A trade- in allowance of $40 200 was received and the balance was paid in cash. Freight charges of $280 and installation costs of $1600 were also paid in cash. Mandurah Manufacturing Ltd estimated Machine 5' useful life and residual value to be 6 years and $5500 respectively. (e) 24 April 2011, Overhauled Machine 3 at a cash cost of $16 910, after which Mandurah Manufacturing Ltd revised its residual value to $5600 and extended its useful life by 2 years. (f) 16 May 2011, Paid for scheduled repairs and maintenance on the machines of $2370 (g) 30 June 2011 Recorded depreciation and scapped Machine 1. Required a. Prepare the journal entries to record the above transactions and events b. Preprare the accumulated depreciation - Machinery Control and Accumulated depreciation - Fixture ledger accounts for the period 01 July 2010 to 30 June 2011.

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts