Question: Question 2: It is spring 2021, and WeWork is attempting to go public by merging with BowX Acquisition, a special-purpose acquisition company. WeWork previously failed

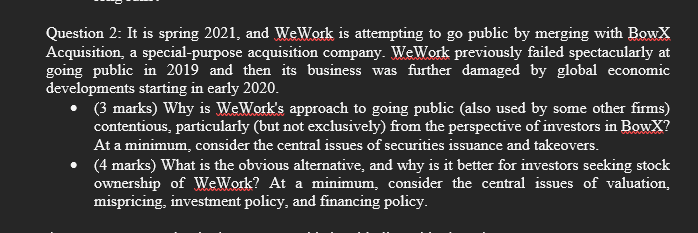

Question 2: It is spring 2021, and WeWork is attempting to go public by merging with BowX Acquisition, a special-purpose acquisition company. WeWork previously failed spectacularly at going public in 2019 and then its business was further damaged by global economic developments starting in early 2020. (3 marks) Why is WeWork's approach to going public (also used by some other firms) contentious, particularly (but not exclusively) from the perspective of investors in BowX? At a minimum, consider the central issues of securities issuance and takeovers. (4 marks) What is the obvious alternative, and why is it better for investors seeking stock ownership of WeWork? At a minimum, consider the central issues of valuation, mispricing, investment policy, and financing policy. Question 2: It is spring 2021, and WeWork is attempting to go public by merging with BowX Acquisition, a special-purpose acquisition company. WeWork previously failed spectacularly at going public in 2019 and then its business was further damaged by global economic developments starting in early 2020. (3 marks) Why is WeWork's approach to going public (also used by some other firms) contentious, particularly (but not exclusively) from the perspective of investors in BowX? At a minimum, consider the central issues of securities issuance and takeovers. (4 marks) What is the obvious alternative, and why is it better for investors seeking stock ownership of WeWork? At a minimum, consider the central issues of valuation, mispricing, investment policy, and financing policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts