Question: Question 2 The pdf file Question 2.pdf has FT article that details the decision of WeWork to go public by merging with a Spac. a)

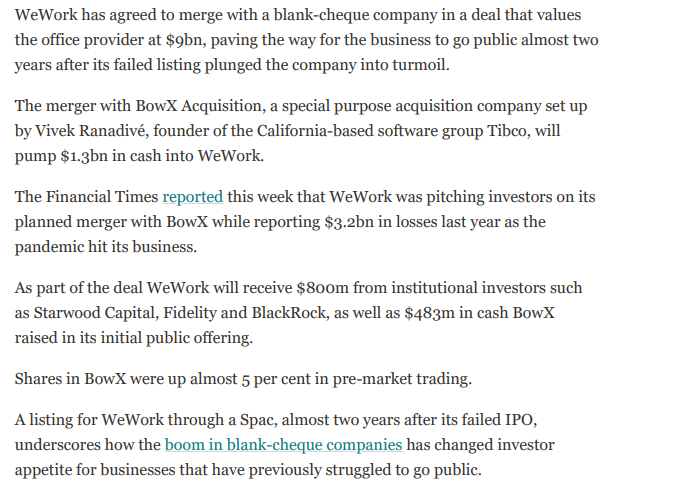

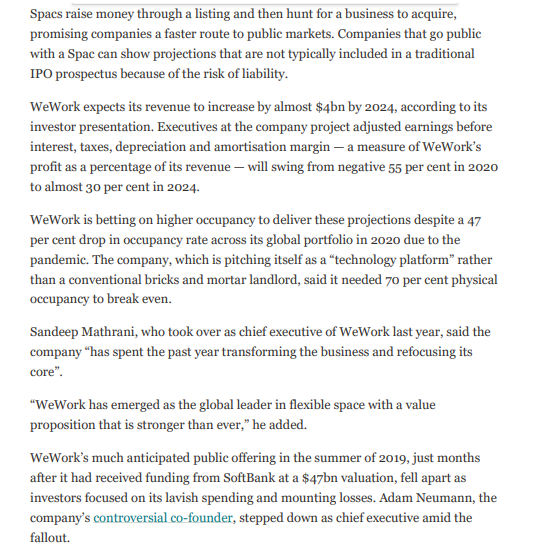

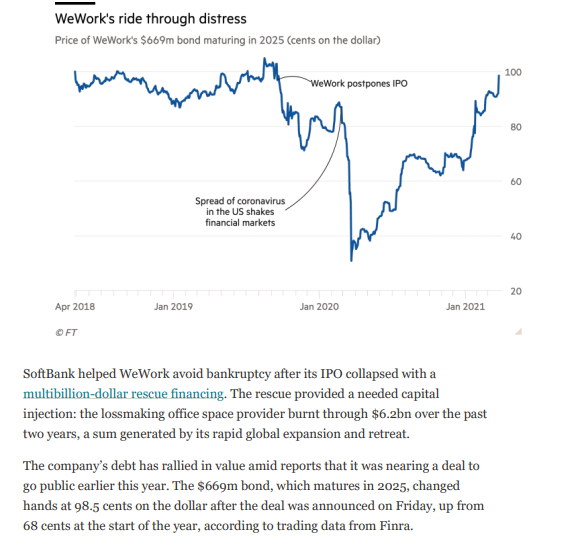

Question 2 The pdf file Question 2.pdf has FT article that details the decision of WeWork to go public by merging with a Spac. a) Briefly explain which, among the different advantages of this type of deal (compared to a traditional IPO), are likely to be more relevant for WeWork. b) Regulators in the US are taking a closer look at Spacs. Would the WeWork situation raise any flag? Is the WeWork decision an example of the situation regulators are worried about? WeWork has agreed to merge with a blank-cheque company in a deal that values the office provider at $9bn, paving the way for the business to go public almost two years after its failed listing plunged the company into turmoil. The merger with BowX Acquisition, a special purpose acquisition company set up by Vivek Ranadiv, founder of the California-based software group Tibco, will pump $1.3bn in cash into WeWork. The Financial Times reported this week that WeWork was pitching investors on its planned merger with BowX while reporting $3.2bn in losses last year as the pandemic hit its business. As part of the deal WeWork will receive $800m from institutional investors such as Starwood Capital, Fidelity and BlackRock, as well as $483m in cash BowX raised in its initial public offering. Shares in BowX were up almost 5 per cent in pre-market trading. A listing for WeWork through a Spac, almost two years after its failed IPO, underscores how the boom in blank-cheque companies has changed investor appetite for businesses that have previously struggled to go public. Spacs raise money through a listing and then hunt for a business to acquire, promising companies a faster route to public markets. Companies that go public with a Spac can show projections that are not typically included in a traditional IPO prospectus because of the risk of liability. WeWork expects its revenue to increase by almost $4bn by 2024, according to its investor presentation. Executives at the company project adjusted earnings before interest, taxes, depreciation and amortisation margin a measure of WeWork's profit as a percentage of its revenue - will swing from negative 55 per cent in 2020 to almost 30 per cent in 2024. WeWork is betting on higher occupancy to deliver these projections despite a 47 per cent drop in occupancy rate across its global portfolio in 2020 due to the pandemic. The company, which is pitching itself as a technology platform rather than a conventional bricks and mortar landlord, said it needed 70 per cent physical occupancy to break even. Sandeep Mathrani, who took over as chief executive of WeWork last year, said the company has spent the past year transforming the business and refocusing its core". WeWork has emerged as the global leader in flexible space with a value proposition that is stronger than ever," he added. WeWork's much anticipated public offering in the summer of 2019, just months after it had received funding from SoftBank at a $47bn valuation, fell apart as investors focused on its lavish spending and mounting losses. Adam Neumann, the company's controversial co-founder, stepped down as chief executive amid the fallout. WeWork's ride through distress Price of WeWork's $669m bond maturing in 2025 (cents on the dollar) 100 WeWork postpones IPO 80 60 Spread of coronavirus in the US shakes financial markets 40 20 Apr 2018 Jan 2019 Jan 2020 Jan 2021 OFT SoftBank helped WeWork avoid bankruptcy after its IPO collapsed with a multibillion-dollar rescue financing. The rescue provided a needed capital injection: the lossmaking office space provider burnt through $6.2bn over the past two years, a sum generated by its rapid global expansion and retreat. The company's debt has rallied in value amid reports that it was nearing a deal to go public earlier this year. The $669m bond, which matures in 2025, changed hands at 98.5 cents on the dollar after the deal was announced on Friday, up from 68 cents at the start of the year, according to trading data from Finra. Question 2 The pdf file Question 2.pdf has FT article that details the decision of WeWork to go public by merging with a Spac. a) Briefly explain which, among the different advantages of this type of deal (compared to a traditional IPO), are likely to be more relevant for WeWork. b) Regulators in the US are taking a closer look at Spacs. Would the WeWork situation raise any flag? Is the WeWork decision an example of the situation regulators are worried about? WeWork has agreed to merge with a blank-cheque company in a deal that values the office provider at $9bn, paving the way for the business to go public almost two years after its failed listing plunged the company into turmoil. The merger with BowX Acquisition, a special purpose acquisition company set up by Vivek Ranadiv, founder of the California-based software group Tibco, will pump $1.3bn in cash into WeWork. The Financial Times reported this week that WeWork was pitching investors on its planned merger with BowX while reporting $3.2bn in losses last year as the pandemic hit its business. As part of the deal WeWork will receive $800m from institutional investors such as Starwood Capital, Fidelity and BlackRock, as well as $483m in cash BowX raised in its initial public offering. Shares in BowX were up almost 5 per cent in pre-market trading. A listing for WeWork through a Spac, almost two years after its failed IPO, underscores how the boom in blank-cheque companies has changed investor appetite for businesses that have previously struggled to go public. Spacs raise money through a listing and then hunt for a business to acquire, promising companies a faster route to public markets. Companies that go public with a Spac can show projections that are not typically included in a traditional IPO prospectus because of the risk of liability. WeWork expects its revenue to increase by almost $4bn by 2024, according to its investor presentation. Executives at the company project adjusted earnings before interest, taxes, depreciation and amortisation margin a measure of WeWork's profit as a percentage of its revenue - will swing from negative 55 per cent in 2020 to almost 30 per cent in 2024. WeWork is betting on higher occupancy to deliver these projections despite a 47 per cent drop in occupancy rate across its global portfolio in 2020 due to the pandemic. The company, which is pitching itself as a technology platform rather than a conventional bricks and mortar landlord, said it needed 70 per cent physical occupancy to break even. Sandeep Mathrani, who took over as chief executive of WeWork last year, said the company has spent the past year transforming the business and refocusing its core". WeWork has emerged as the global leader in flexible space with a value proposition that is stronger than ever," he added. WeWork's much anticipated public offering in the summer of 2019, just months after it had received funding from SoftBank at a $47bn valuation, fell apart as investors focused on its lavish spending and mounting losses. Adam Neumann, the company's controversial co-founder, stepped down as chief executive amid the fallout. WeWork's ride through distress Price of WeWork's $669m bond maturing in 2025 (cents on the dollar) 100 WeWork postpones IPO 80 60 Spread of coronavirus in the US shakes financial markets 40 20 Apr 2018 Jan 2019 Jan 2020 Jan 2021 OFT SoftBank helped WeWork avoid bankruptcy after its IPO collapsed with a multibillion-dollar rescue financing. The rescue provided a needed capital injection: the lossmaking office space provider burnt through $6.2bn over the past two years, a sum generated by its rapid global expansion and retreat. The company's debt has rallied in value amid reports that it was nearing a deal to go public earlier this year. The $669m bond, which matures in 2025, changed hands at 98.5 cents on the dollar after the deal was announced on Friday, up from 68 cents at the start of the year, according to trading data from Finra

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts