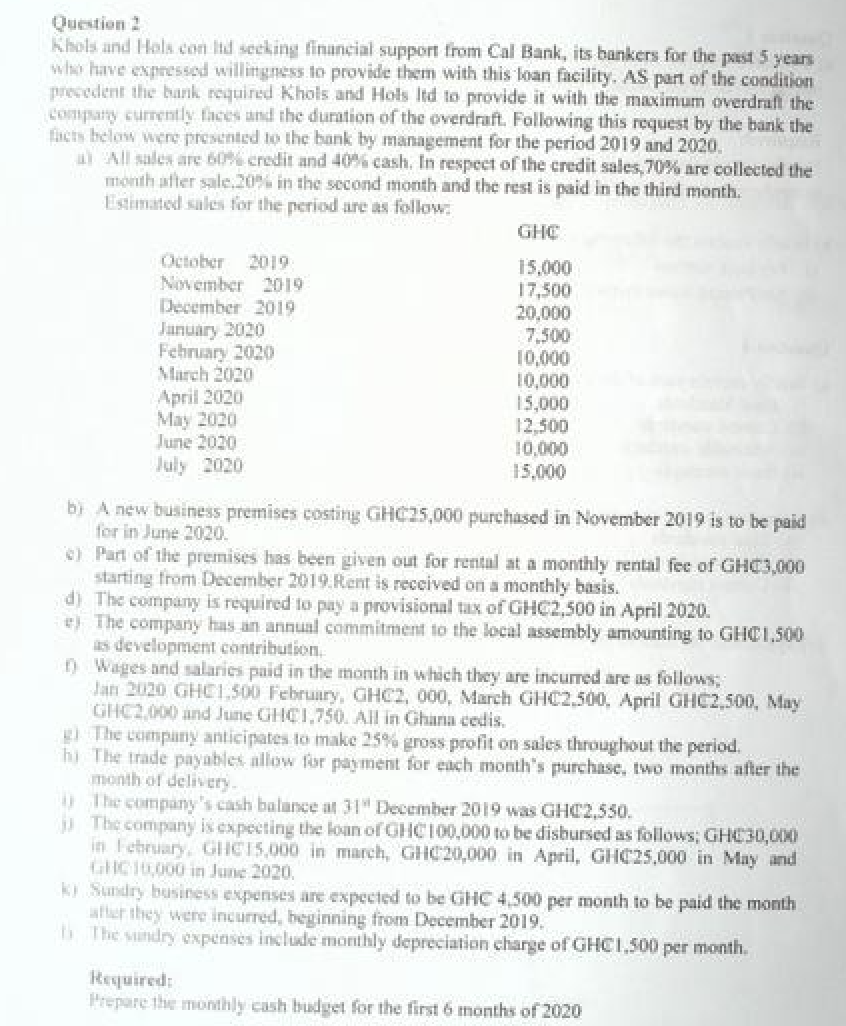

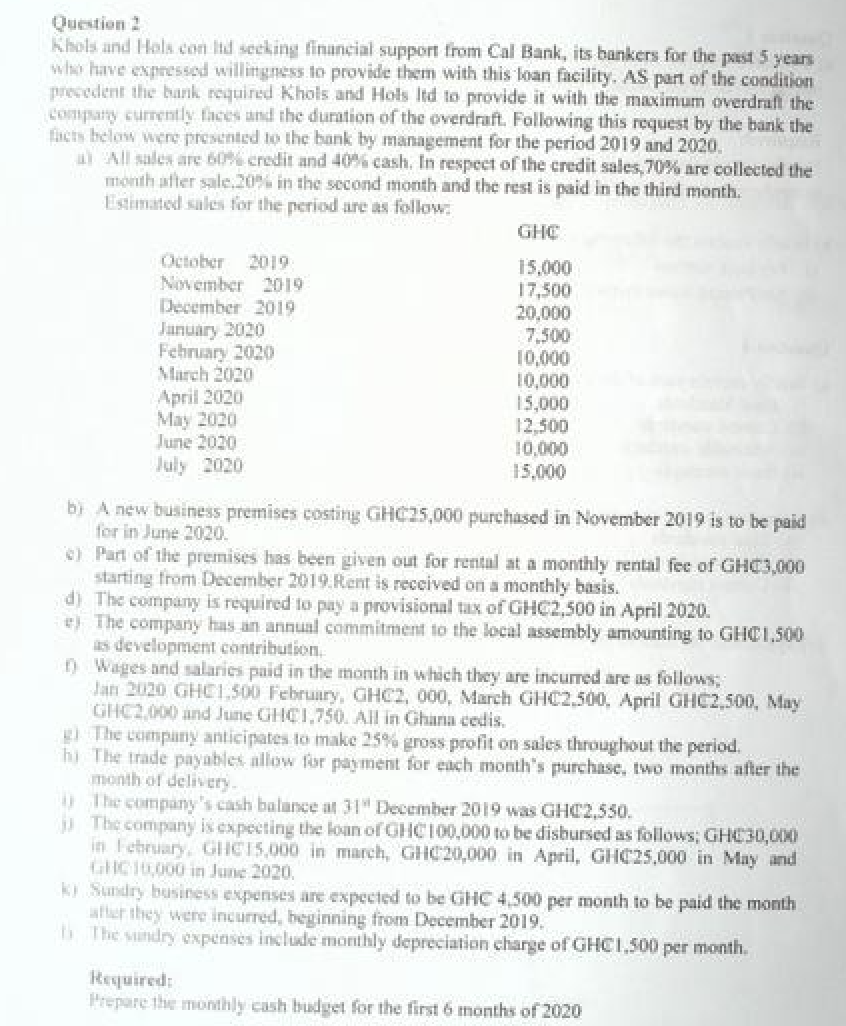

Question 2 Khols and Hols con ltd seeking financial support from Cal Bank, its bankers for the past 5 years who have expressed willingness to provide them with this loan facility. AS part of the condition precedent the bank required Khols and Hols Itd to provide it with the maximum overdraft the company currently faces and the duration of the overdraft. Following this request by the bank the facts below were presented to the bank by management for the period 2019 and 2020. a) All sales are 60% credit and 40% cash. In respect of the credit sales,70% are collected the month after sale.20% in the second month and the rest is paid in the third month. Estimated sales for the period are as follow: GHC October 2019 15,000 November 2019 17,500 20,000 December 2019 January 2020 February 2020 7,500 10,000 March 2020 10,000 April 2020 15,000 May 2020- 12,500 June 2020 10,000 July 2020 15,000 b) A new business premises costing GHC25,000 purchased in November 2019 is to be paid for in June 2020. e) Part of the premises has been given out for rental at a monthly rental fee of GHC3,000 starting from December 2019.Rent is received on a monthly basis. d) The company is required to pay a provisional tax of GHC2,500 in April 2020. e) The company has an annual commitment to the local assembly amounting to GHC1,500 as development contribution 1) Wages and salaries paid in the month in which they are incurred are as follows Jan 2020 GHC1,500 February, GHC2, 000, March GHC2,500, April GHC2,500, May GHC2,000 and June GHC1,750. All in Ghana cedis. The company anticipates to make 25% gross profit on sales throughout the period. h) The trade payables allow for payment for each month's purchase, two months after the month of delivery. The company's cash balance at 31 December 2019 was GHC2,550. The company is expecting the loan of GHC 100,000 to be disbursed as follows; GHC30,000 in February, GHC15,000 in march, GHC20,000 in April, GHC25,000 in May and GHC10,000 in June 2020. k) Sundry business expenses are expected to be GHC 4,500 per month to be paid the month after they were incurred, beginning from December 2019. The sundry expenses include monthly depreciation charge of GHC1,500 per month. Required: Prepare the monthly cash budget for the first 6 months of 2020