Question: Question 2 The Capital Asset Pricing Model (CAPM) theory implies that the excess returns on an asset or a portfolio depend on the excess returns

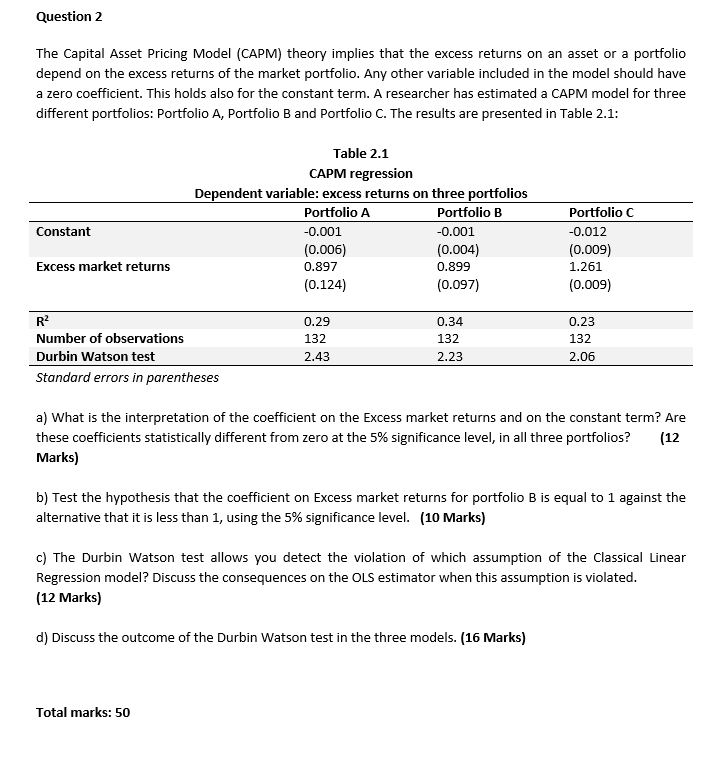

Question 2 The Capital Asset Pricing Model (CAPM) theory implies that the excess returns on an asset or a portfolio depend on the excess returns of the market portfolio. Any other variable included in the model should have a zero coefficient. This holds also for the constant term. A researcher has estimated a CAPM model for three different portfolios: Portfolio A, Portfolio B and Portfolio C. The results are presented in Table 2.1: Table 2.1 CAPM regression Dependent variable: excess returns on three portfolios Portfolio A Portfolio B -0.001 -0.001 (0.006) (0.004) 0.897 0.899 (0.124) (0.097) Constant Portfolio C -0.012 (0.009) 1.261 (0.009) Excess market returns R2 Number of observations Durbin Watson test Standard errors in parentheses 0.29 132 2.43 0.34 132 2.23 0.23 132 2.06 a) What is the interpretation of the coefficient on the Excess market returns and on the constant term? Are these coefficients statistically different from zero at the 5% significance level, in all three portfolios? (12 Marks) b) Test the hypothesis that the coefficient on Excess market returns for portfolio B is equal to 1 against the alternative that it is less than 1, using the 5% significance level. (10 Marks) c) The Durbin Watson test allows you detect the violation of which assumption of the Classical Linear Regression model? Discuss the consequences on the OLS estimator when this assumption is violated. (12 Marks) d) Discuss the outcome of the Durbin Watson test in the three models. (16 Marks) Total marks: 50 Question 2 The Capital Asset Pricing Model (CAPM) theory implies that the excess returns on an asset or a portfolio depend on the excess returns of the market portfolio. Any other variable included in the model should have a zero coefficient. This holds also for the constant term. A researcher has estimated a CAPM model for three different portfolios: Portfolio A, Portfolio B and Portfolio C. The results are presented in Table 2.1: Table 2.1 CAPM regression Dependent variable: excess returns on three portfolios Portfolio A Portfolio B -0.001 -0.001 (0.006) (0.004) 0.897 0.899 (0.124) (0.097) Constant Portfolio C -0.012 (0.009) 1.261 (0.009) Excess market returns R2 Number of observations Durbin Watson test Standard errors in parentheses 0.29 132 2.43 0.34 132 2.23 0.23 132 2.06 a) What is the interpretation of the coefficient on the Excess market returns and on the constant term? Are these coefficients statistically different from zero at the 5% significance level, in all three portfolios? (12 Marks) b) Test the hypothesis that the coefficient on Excess market returns for portfolio B is equal to 1 against the alternative that it is less than 1, using the 5% significance level. (10 Marks) c) The Durbin Watson test allows you detect the violation of which assumption of the Classical Linear Regression model? Discuss the consequences on the OLS estimator when this assumption is violated. (12 Marks) d) Discuss the outcome of the Durbin Watson test in the three models. (16 Marks) Total marks: 50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts