Question: Question 2 (Total: 20 marks) (a) The Black-Scholes framework is assumed. Consider a 10-month at-the-money European put option on futures contract. (i) Derive a formula

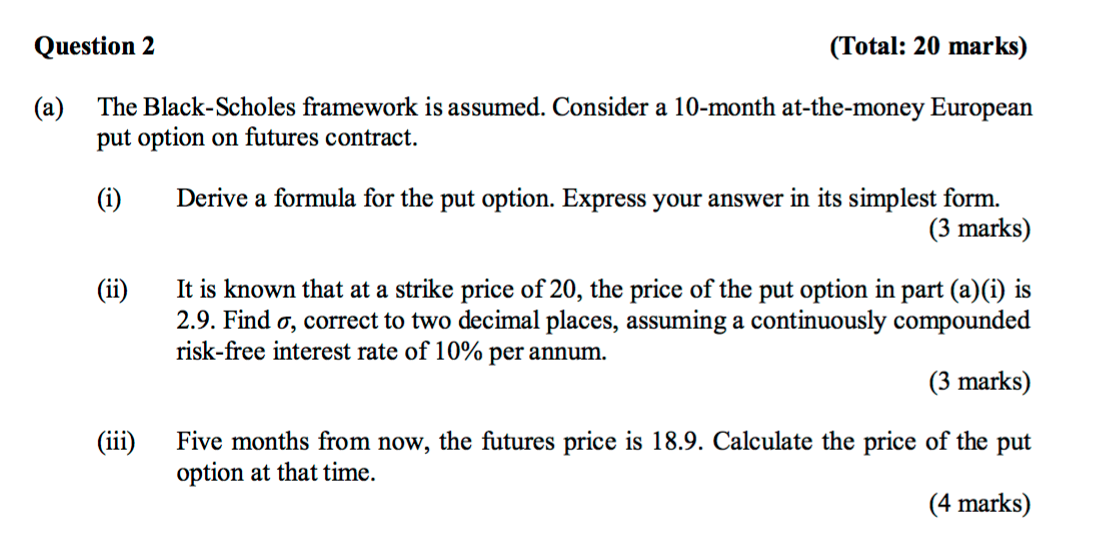

Question 2 (Total: 20 marks) (a) The Black-Scholes framework is assumed. Consider a 10-month at-the-money European put option on futures contract. (i) Derive a formula for the put option. Express your answer in its simplest form. (3 marks) (ii) It is known that at a strike price of 20, the price of the put option in part (a)(i) is 2.9. Find o, correct to two decimal places, assuming a continuously compounded risk-free interest rate of 10% per annum. (3 marks) (iii) Five months from now, the futures price is 18.9. Calculate the price of the put option at that time. (4 marks) Question 2 (Total: 20 marks) (a) The Black-Scholes framework is assumed. Consider a 10-month at-the-money European put option on futures contract. (i) Derive a formula for the put option. Express your answer in its simplest form. (3 marks) (ii) It is known that at a strike price of 20, the price of the put option in part (a)(i) is 2.9. Find o, correct to two decimal places, assuming a continuously compounded risk-free interest rate of 10% per annum. (3 marks) (iii) Five months from now, the futures price is 18.9. Calculate the price of the put option at that time. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts