Question: QUESTION 2 You work for ABC Ventures and you have been asked to evaluate investing in a startup firm that makes smart road technology to

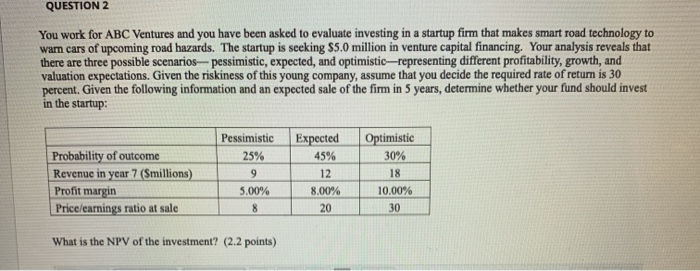

QUESTION 2 You work for ABC Ventures and you have been asked to evaluate investing in a startup firm that makes smart road technology to wam cars of upcoming road hazards. The startup is seeking $5.0 million in venture capital financing. Your analysis reveals that there are three possible scenarios- pessimistic, expected, and optimistic-representing different profitability, growth, and valuation expectations. Given the riskiness of this young company, assume that you decide the required rate of retum is 30 percent. Given the following information and an expected sale of the firm in 5 years, determine whether your fund should invest in the startup: Probability of outcome Revenue in year 7 (Smillions) Profit margin Price/earnings ratio at sale Pessimistic 25% 9 5.00% 8 Expected 45% 12 8.00% 20 Optimistic 30% 18 10.00% 30 What is the NPV of the investment? (2.2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts