Question: Question 20 3.3 points Save Answer The company has a target D/E ratio - 2/3. Bonds with face value of $1,000 pay a 10% coupon,

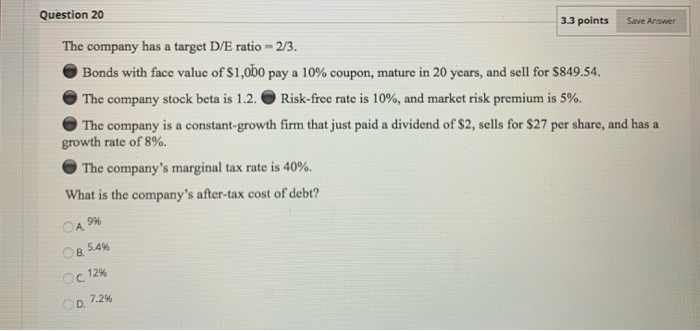

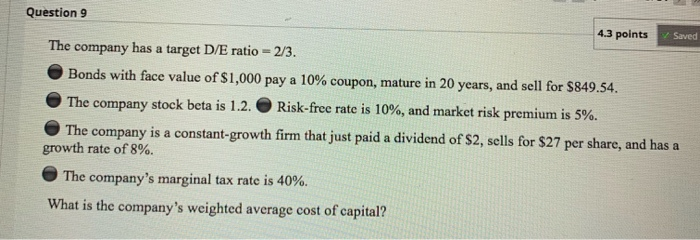

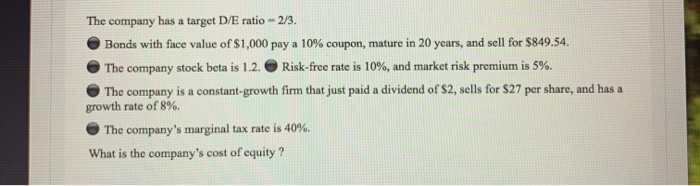

Question 20 3.3 points Save Answer The company has a target D/E ratio - 2/3. Bonds with face value of $1,000 pay a 10% coupon, mature in 20 years, and sell for $849.54. The company stock beta is 1.2. Risk-free rate is 10%, and market risk premium is 5%. The company is a constant-growth firm that just paid a dividend of $2, sells for $27 per share, and has a growth rate of 8% The company's marginal tax rate is 40%. What is the company's after-tax cost of debt? A 9% B. 5.4% C 12% OD 7.2% Saved Question 9 4.3 points The company has a target D/E ratio - 2/3. Bonds with face value of $1,000 pay a 10% coupon, mature in 20 years, and sell for $849.54. The company stock beta is 1.2. Risk-free rate is 10%, and market risk premium is 5%. The company is a constant-growth firm that just paid a dividend of $2, sells for $27 per share, and has a growth rate of 8%. The company's marginal tax rate is 40%. What is the company's weighted average cost of capital? The company has a target D/E ratio - 2/3. Bonds with face value of $1,000 pay a 10% coupon, mature in 20 years, and sell for $849.54. The company stock beta is 1.2. Risk-free rate is 10%, and market risk premium is 5%. The company is a constant-growth firm that just paid a dividend of S2, sells for $27 per share, and has a growth rate of 8%. The company's marginal tax rate is 40%. What is the company's cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts