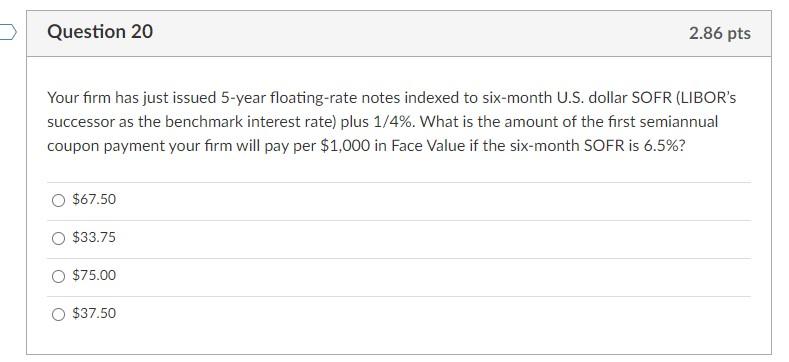

Question: Question 20 Your firm has just issued 5-year floating-rate notes indexed to six-month U.S. dollar SOFR (LIBOR's successor as the benchmark interest rate) plus 1/4%.

Question 20 Your firm has just issued 5-year floating-rate notes indexed to six-month U.S. dollar SOFR (LIBOR's successor as the benchmark interest rate) plus 1/4%. What is the amount of the first semiannual coupon payment your firm will pay per $1,000 in Face Value if the six-month SOFR is 6.5%? $67.50 $33.75 $75.00 2.86 pts $37.50

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock