Question: Question 21 (20 points) Problem 1 As an option trader you decide to sell a straddle by selling a put option and a call option

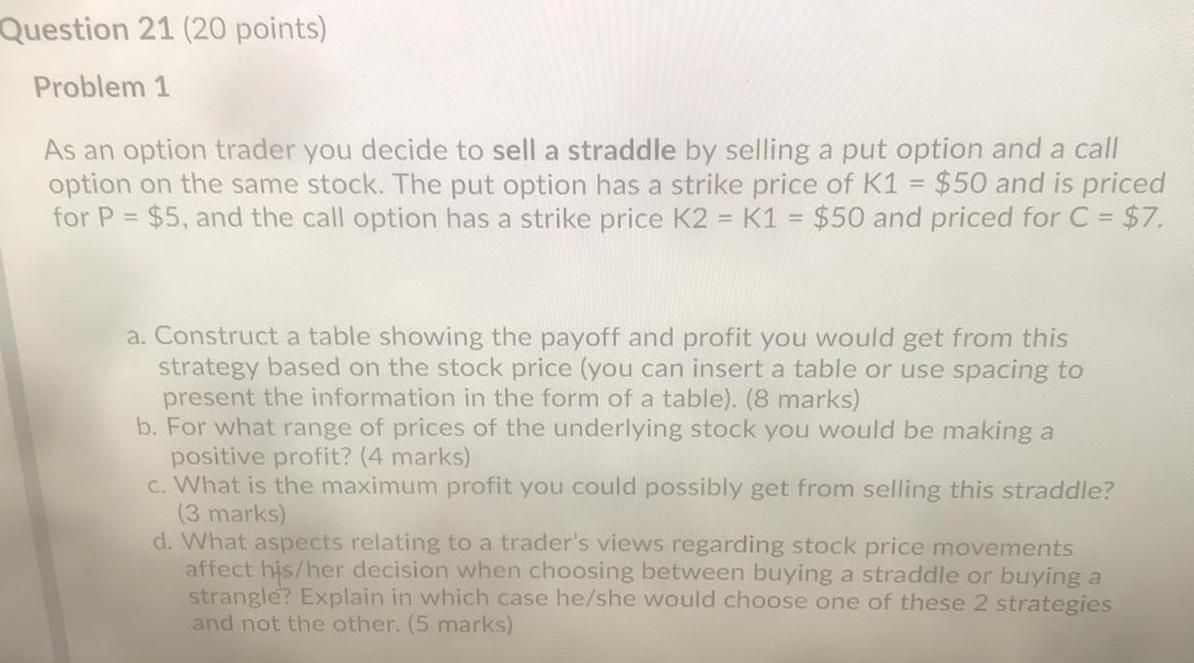

Question 21 (20 points) Problem 1 As an option trader you decide to sell a straddle by selling a put option and a call option on the same stock. The put option has a strike price of K1 = $50 and is priced for p = $5, and the call option has a strike price K2 = K1 = $50 and priced for C = $7. a. Construct a table showing the payoff and profit you would get from this strategy based on the stock price (you can insert a table or use spacing to present the information in the form of a table). (8 marks) b. For what range of prices of the underlying stock you would be making a positive profit? (4 marks) c. What is the maximum profit you could possibly get from selling this straddle? (3 marks) d. What aspects relating to a trader's views regarding stock price movements affect his/her decision when choosing between buying a straddle or buying a strangle? Explain in which case he/she would choose one of these 2 strategies and not the other

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts