Question: QUESTION 21 Which statement best describes a bear steepener? Interest rates rise and long term rates rise more than short term rates Interest rates rise

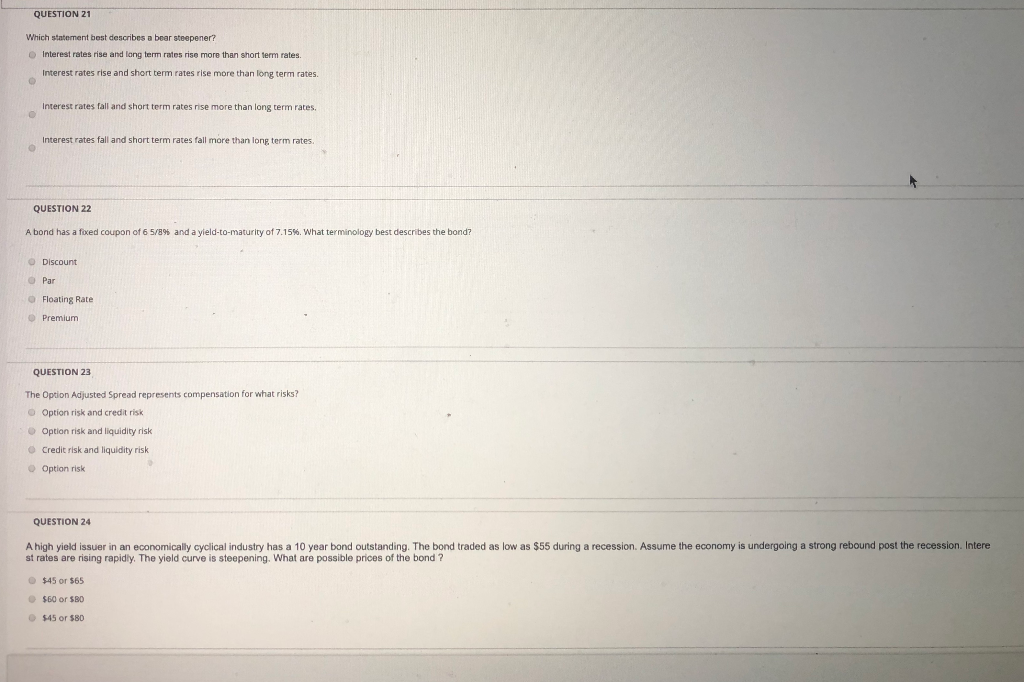

QUESTION 21 Which statement best describes a bear steepener? Interest rates rise and long term rates rise more than short term rates Interest rates rise and short term rates rise more than long term rates. Interest rates all and short term rates rise more than long term rates, Interest rates fall and short term rates fall more than long term rates. QUESTION 22 A bond has a foxed coupon of 6 5/8% and a yield-to-maturity of 7.15%. What terminology best describes the bond? Discount OPar Floating Rate O Premium QUESTION 23 The Option Adjusted Spread represents compensation for what risks? Option risk and credit risk Option risk and liquidity risk Credit risk and liquidity risk Option risk QUESTION 24 A high yield issuer in an economically cyclical industry has a 10 year bond outstanding. The bond traded as low as $55 during a recession. Assume the economy is undergoing a strong rebound post the recession. Intere st rates are rising rapidly. The yield curve is steepening. What are possible prices of the bond ? $45 or $65 $60 or $80 545 or $80

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts