Question: Question 22 (20 marks) Rex Simms is planning to purchase a house but knows that he can only come up with the required deposit of

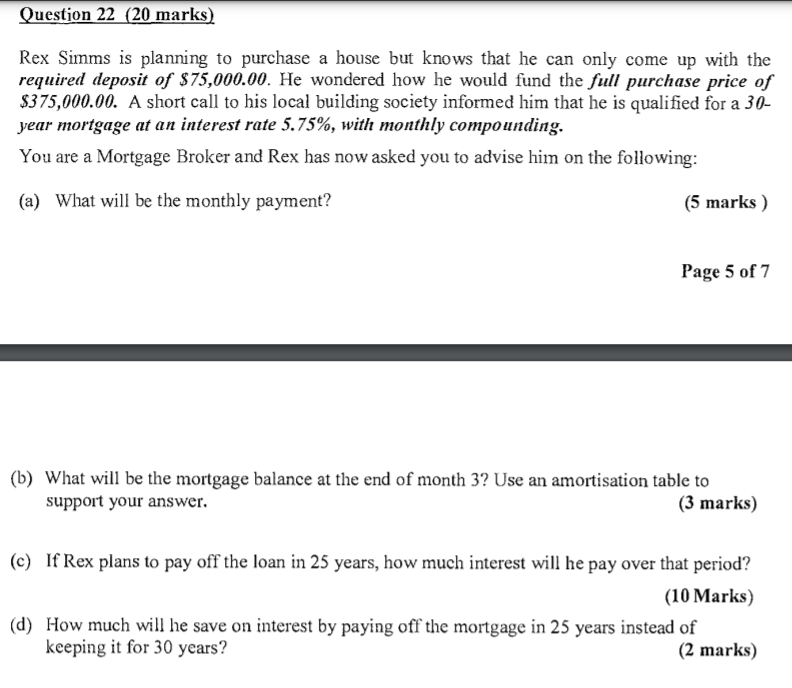

Question 22 (20 marks) Rex Simms is planning to purchase a house but knows that he can only come up with the required deposit of $75,000.00. He wondered how he would fund the full purchase price of $375,000.00. A short call to his local building society informed him that he is qualified for a 30- year mortgage at an interest rate 5.75%, with monthly compounding. You are a Mortgage Broker and Rex has now asked you to advise him on the following: (a) What will be the monthly payment? (5 marks) Page 5 of 7 (b) What will be the mortgage balance at the end of month 3? Use an amortisation table to support your answer. (3 marks) (c) If Rex plans to pay off the loan in 25 years, how much interest will he pay over that period? (10 Marks) (d) How much will he save on interest by paying off the mortgage in 25 years instead of keeping it for 30 years? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts