Question: Question 22 (30 points) Please upload The Excel file in the folder titled Exam 2 File Upload The risk free rate is 3% and the

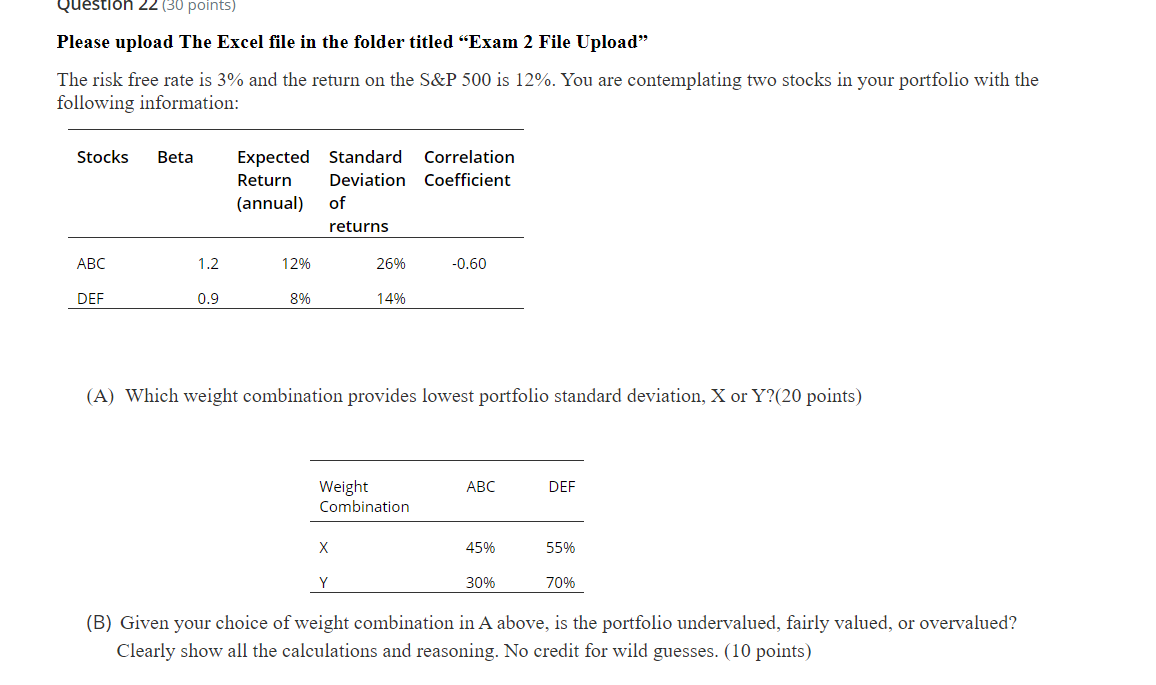

Question 22 (30 points) Please upload The Excel file in the folder titled Exam 2 File Upload" The risk free rate is 3% and the return on the S&P 500 is 12%. You are contemplating two stocks in your portfolio with the following information: Stocks Beta Correlation Coefficient Expected Standard Return Deviation (annual) of returns ABC 1.2 12% 26% -0.60 DEF 0.9 8% 14% (A) Which weight combination provides lowest portfolio standard deviation, X or Y?(20 points) ABC DEF Weight Combination X 45% 55% Y 30% 70% (B) Given your choice of weight combination in A above, is the portfolio undervalued, fairly valued, or overvalued? Clearly show all the calculations and reasoning. No credit for wild guesses. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts