Question: Question 23 (10 points) (DO NOT write your answer here! To receive full credit, show clearly your complete work on a piece of paper and

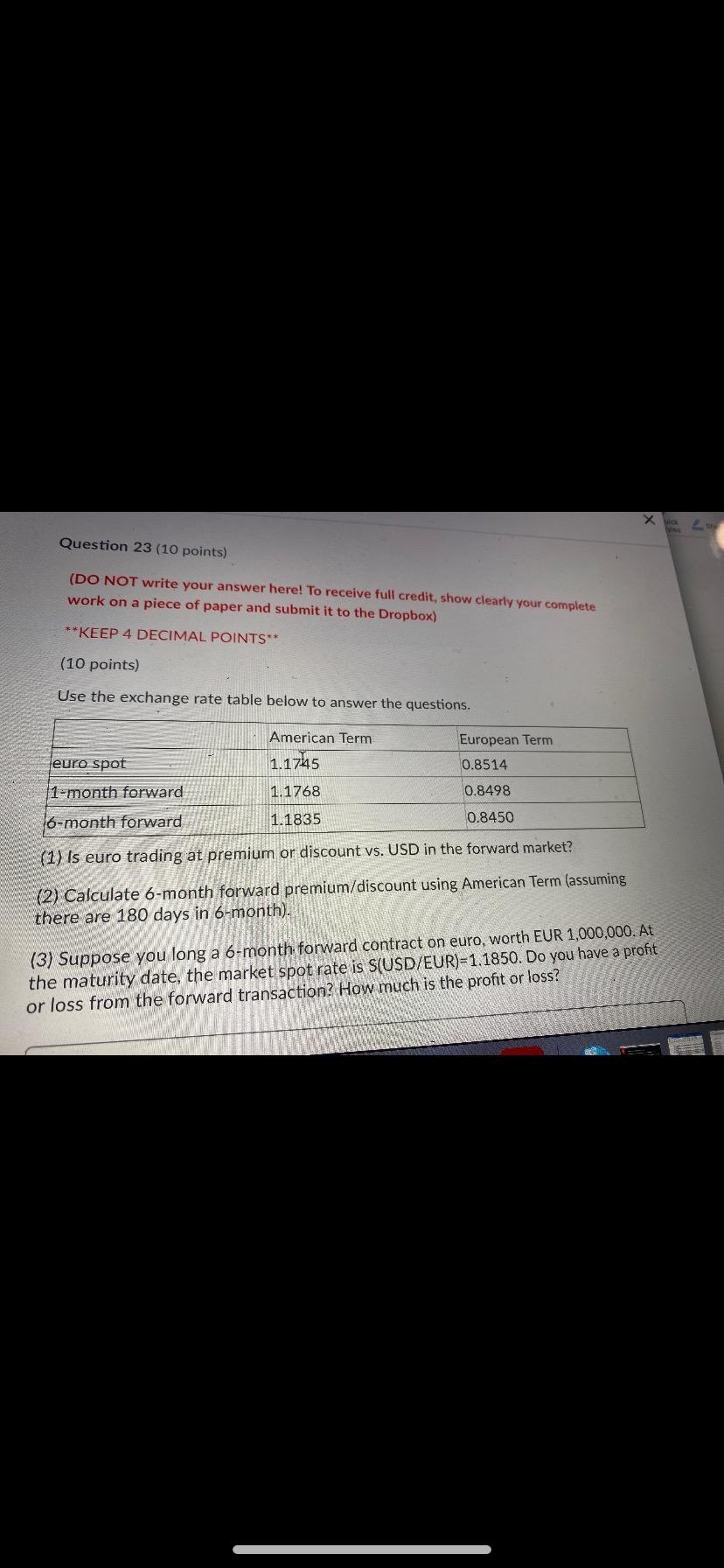

Question 23 (10 points) (DO NOT write your answer here! To receive full credit, show clearly your complete work on a piece of paper and submit it to the Dropbox) **KEEP 4 DECIMAL POINTS** (10 points) Use the exchange rate table below to answer the questions. European Term euro spot American Term 1.1745 1.1768 0.8514 0.8498 11-month forward 6-month forward 1.1835 0.8450 (1) Is euro trading at premium or discount vs. USD in the forward market? (2) Calculate 6-month forward premium/discount using American Term (assuming there are 180 days in 6-month). (3) Suppose you long a 6-month forward contract on euro, worth EUR 1,000,000. At the maturity date, the market spot rate is S(USD/EUR)=1.1850. Do you have a profit or loss from the forward transaction? How much is the profit or loss? Question 23 (10 points) (DO NOT write your answer here! To receive full credit, show clearly your complete work on a piece of paper and submit it to the Dropbox) **KEEP 4 DECIMAL POINTS** (10 points) Use the exchange rate table below to answer the questions. European Term euro spot American Term 1.1745 1.1768 0.8514 0.8498 11-month forward 6-month forward 1.1835 0.8450 (1) Is euro trading at premium or discount vs. USD in the forward market? (2) Calculate 6-month forward premium/discount using American Term (assuming there are 180 days in 6-month). (3) Suppose you long a 6-month forward contract on euro, worth EUR 1,000,000. At the maturity date, the market spot rate is S(USD/EUR)=1.1850. Do you have a profit or loss from the forward transaction? How much is the profit or loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts