Question: X Question 24 (10 points) (DO NOT write your answer here! To receive full credit, show clearly your complete work on a piece of paper

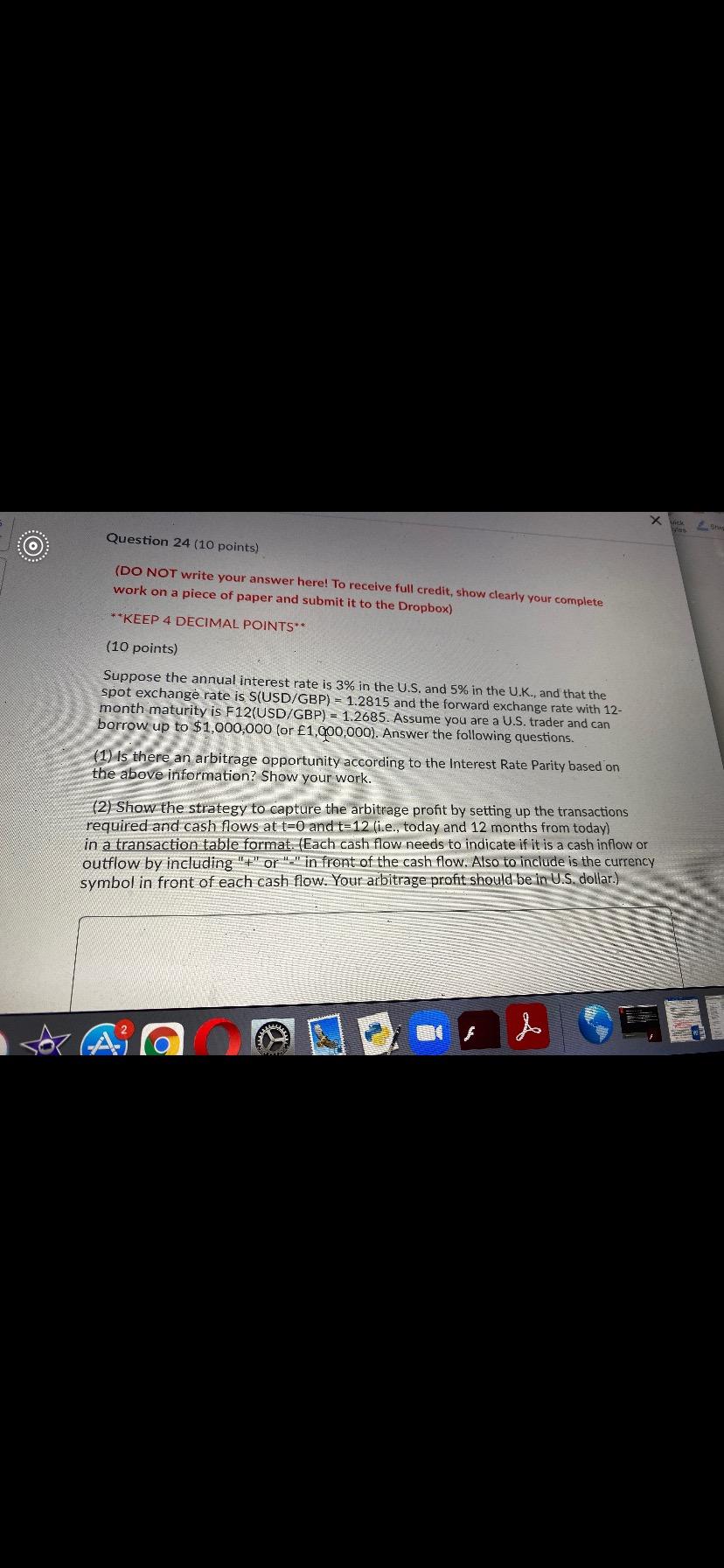

X Question 24 (10 points) (DO NOT write your answer here! To receive full credit, show clearly your complete work on a piece of paper and submit it to the Dropbox) **KEEP 4 DECIMAL POINTS** (10 points) Suppose the annual interest rate is 3% in the U.S. and 5% in the U.K., and that the spot exchange rate is S(USD/GBP) - 1.2815 and the forward exchange rate with 12- month maturity is F12(USD/GBP) = 1.2685. Assume you are a U.S. trader and can borrow up to $1,000,000 (or 1,000,000). Answer the following questions. (1) Is there an arbitrage opportunity according to the Interest Rate Parity based on the above information? Show your work. (2) Show the strategy to capture the arbitrage profit by setting up the transactions required and cash flows at t=0 and t=12 (i.e., today and 12 months from today) in a transaction table format. (Each cash flow needs to indicate if it is a cash inflow or outflow by including "t" or "-" in front of the cash flow. Also to include is the currency symbol in front of each cash flow. Your arbitrage profit should be in U.S. dollar.) Tor A & F X Question 24 (10 points) (DO NOT write your answer here! To receive full credit, show clearly your complete work on a piece of paper and submit it to the Dropbox) **KEEP 4 DECIMAL POINTS** (10 points) Suppose the annual interest rate is 3% in the U.S. and 5% in the U.K., and that the spot exchange rate is S(USD/GBP) - 1.2815 and the forward exchange rate with 12- month maturity is F12(USD/GBP) = 1.2685. Assume you are a U.S. trader and can borrow up to $1,000,000 (or 1,000,000). Answer the following questions. (1) Is there an arbitrage opportunity according to the Interest Rate Parity based on the above information? Show your work. (2) Show the strategy to capture the arbitrage profit by setting up the transactions required and cash flows at t=0 and t=12 (i.e., today and 12 months from today) in a transaction table format. (Each cash flow needs to indicate if it is a cash inflow or outflow by including "t" or "-" in front of the cash flow. Also to include is the currency symbol in front of each cash flow. Your arbitrage profit should be in U.S. dollar.) Tor A & F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts