Question: Question 27 (3.3 points) Please consider the following information for the next 5 questions. UCD (U.S. based MNC) will receive 350,000 euros in one year.

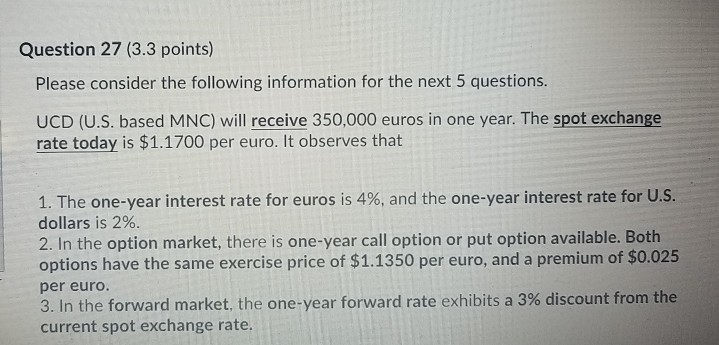

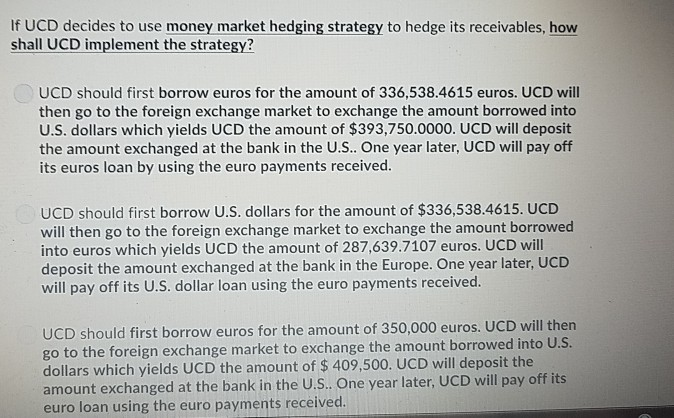

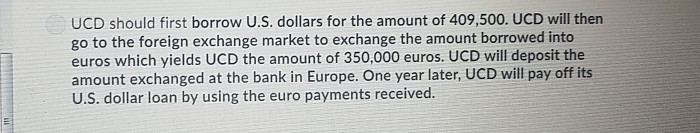

Question 27 (3.3 points) Please consider the following information for the next 5 questions. UCD (U.S. based MNC) will receive 350,000 euros in one year. The spot exchange rate today is $1.1700 per euro. It observes that I. The one-year interest rate for euros is 4%, and the one-year interest rate for US. dollars is 2%. 2. In the option market, there is one-year call option or put option available. Both options have the same exercise price of $1.1350 per euro, and a premium of $0.025 per euro. 3. In the forward market, the one-year forward rate exhibits a 3% discount from the current spot exchange rate. If UCD decides to use money market hedging strategy to hedge its receivables, how shall UCD implement the strategy? UCD should first borrow euros for the amount of 336,538.4615 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $393,750.0000. UCD will deposit the amount exchanged at the bank in the U.S.. One year later, UCD will pay off its euros loan by using the euro payments received. UCD should first borrow U.S. dollars for the amount of $336,538.4615. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 287,639.7107 euros. UCD will deposit the amount exchanged at the bank in the Europe. One year later, UCD will pay off its U.S. dollar loan using the euro payments received UCD should first borrow euros for the amount of 350,000 euros. UCD will then go to the foreign exchange market to exchange the amount borrowed into U.S. dollars which yields UCD the amount of $ 409,500. UCD will deposit the amount exchanged at the bank in the U.S. One year later, UCD will pay off its euro loan using the euro payments received. UCD should first borrow U.S. dollars for the amount of 409,500. UCD will then go to the foreign exchange market to exchange the amount borrowed into euros which yields UCD the amount of 350,000 euros. UCD will deposit the amount exchanged at the bank in Europe. One year later, UCD will pay off its U.S. dollar loan by using the euro payments received

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts