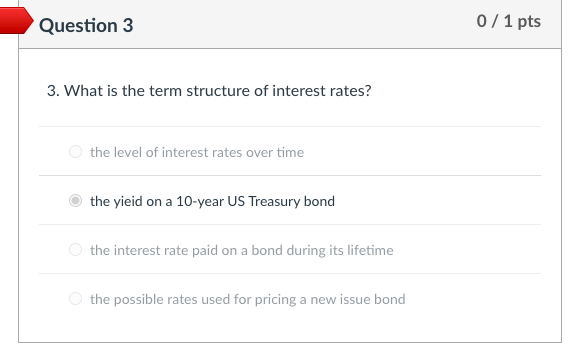

Question: Question 3 0 / 1 pts 3. What is the term structure of interest rates? the level of interest rates over time the yieid on

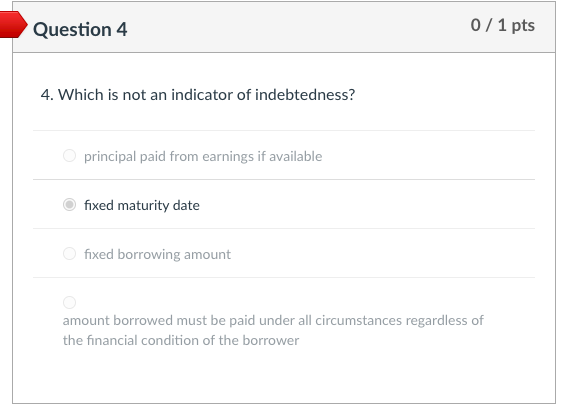

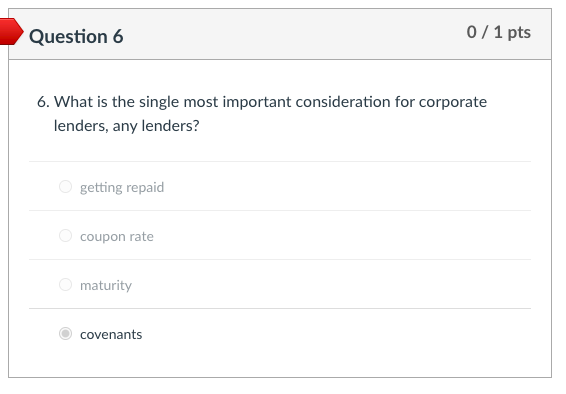

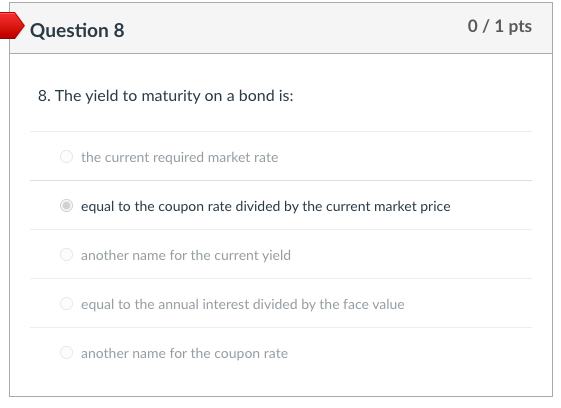

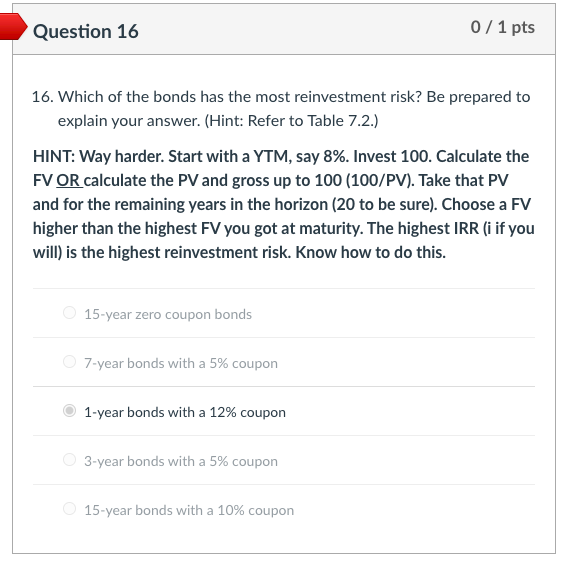

Question 3 0 / 1 pts 3. What is the term structure of interest rates? the level of interest rates over time the yieid on a 10-year US Treasury bond the interest rate paid on a bond during its lifetime the possible rates used for pricing a new issue bond Question 4 0 / 1 pts 4. Which is not an indicator of indebtedness? principal paid from earnings if available fixed maturity date fixed borrowing amount amount borrowed must be paid under all circumstances regardless of the financial condition of the borrower Question 6 0 / 1 pts 6. What is the single most important consideration for corporate lenders, any lenders? getting repaid coupon rate maturity covenants Question 8 0 / 1 pts 8. The yield to maturity on a bond is: the current required market rate equal to the coupon rate divided by the current market price another name for the current yield equal to the annual interest divided by the face value O another name for the coupon rate Question 16 0/1 pts 16. Which of the bonds has the most reinvestment risk? Be prepared to explain your answer. (Hint: Refer to Table 7.2.) HINT: Way harder. Start with a YTM, say 8%. Invest 100. Calculate the FV OR calculate the PV and gross up to 100 (100/PV). Take that PV and for the remaining years in the horizon (20 to be sure). Choose a FV higher than the highest FV you got at maturity. The highest IRR (i if you will) is the highest reinvestment risk. Know how to do this. 15-year zero coupon bonds 7-year bonds with a 5% coupon 1-year bonds with a 12% coupon 3-year bonds with a 5% coupon 15-year bonds with a 10% coupon

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts