Question: QUESTION 3 (20 Marks) 3.1 REQUIRED Use the information provided below to calculate the following ratios for 2019. Where applicable, round off answers to two

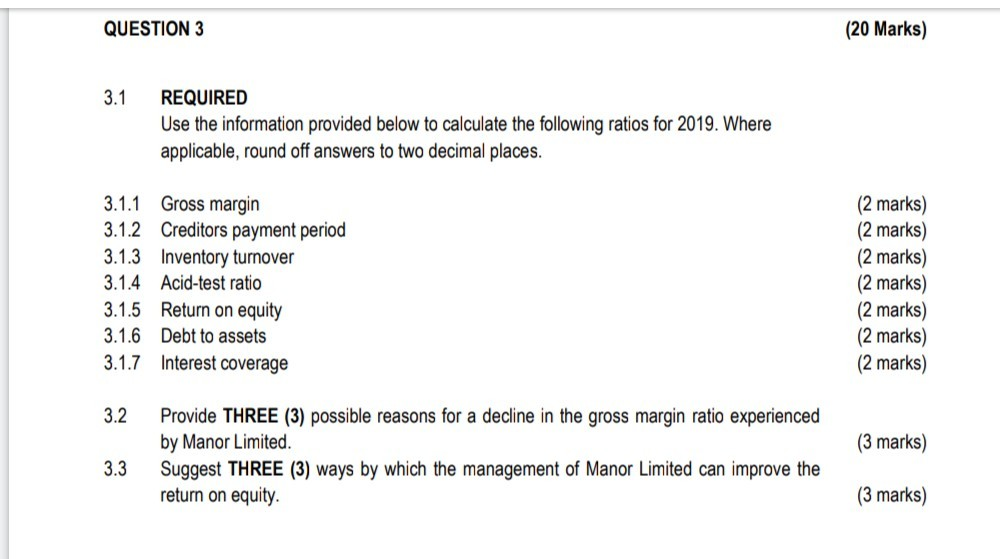

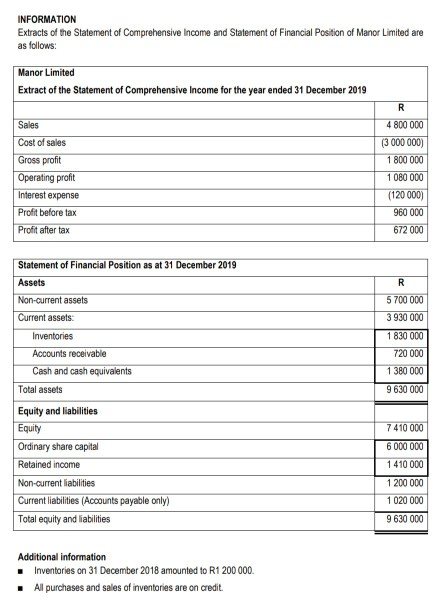

QUESTION 3 (20 Marks) 3.1 REQUIRED Use the information provided below to calculate the following ratios for 2019. Where applicable, round off answers to two decimal places. 3.1.1 Gross margin 3.1.2 Creditors payment period 3.1.3 Inventory turnover 3.1.4 Acid-test ratio 3.1.5 Return on equity 3.1.6 Debt to assets 3.1.7 Interest coverage (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) 3.2 (3 marks) Provide THREE (3) possible reasons for a decline in the gross margin ratio experienced by Manor Limited. Suggest THREE (3) ways by which the management of Manor Limited can improve the return on equity. 3.3 (3 marks) INFORMATION Extracts of the Statement of Comprehensive Income and Statement of Financial Position of Manor Limited are as follows: Manor Limited Extract of the Statement of Comprehensive Income for the year ended 31 December 2019 R 4 800 000 (3 000 000) 1 800 000 Sales Cost of sales Gross profit Operating profit Interest expense Profit before tax Profit after tax 1 080 000 (120 000) 960 000 672 000 Statement of Financial Position as at 31 December 2019 Assets R 5 700 000 3 930 000 1 830 000 720 000 1 380 000 9 630 000 Non-current assets Current assets Inventories Accounts receivable Cash and cash equivalents Total assets Equity and liabilities Equity Ordinary share capital Retained income Non-current liabilities Current liabilities (Accounts payable only) Total equity and liabilities 7 410 000 6 000 000 1 410 000 1 200 000 1 020 000 9 630 000 Additional information Inventories on 31 December 2018 amounted to R1 200 000 All purchases and sales of inventories are on credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock