Question: Question 3. (25 points) You are working for a mobile phone producer and your company needs micro processors to be used in their final products

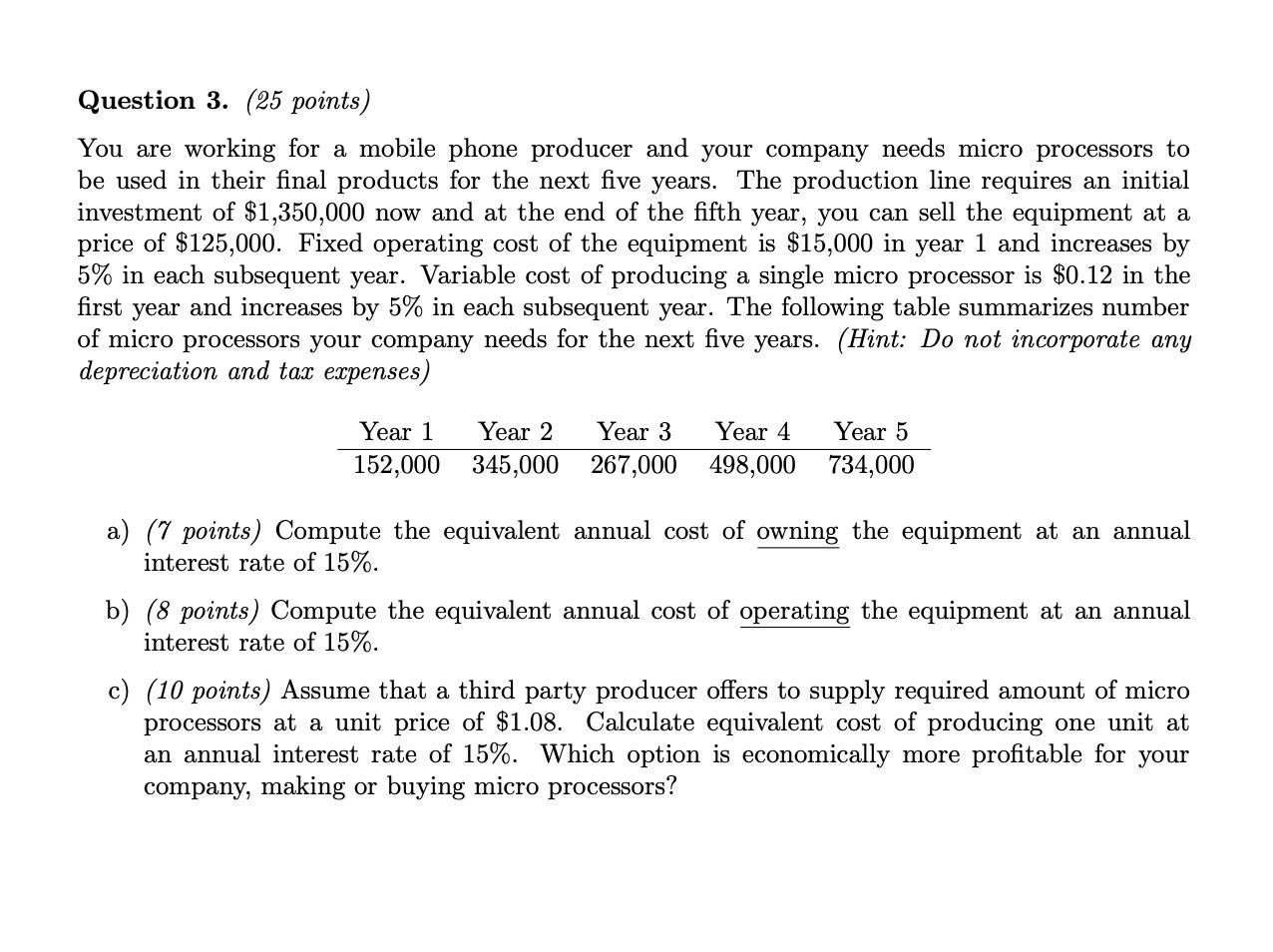

Question 3. (25 points) You are working for a mobile phone producer and your company needs micro processors to be used in their final products for the next five years. The production line requires an initial investment of $1,350,000 now and at the end of the fifth year, you can sell the equipment at a price of $125,000. Fixed operating cost of the equipment is $15,000 in year 1 and increases by 5% in each subsequent year. Variable cost of producing a single micro processor is $0.12 in the first year and increases by 5% in each subsequent year. The following table summarizes number of micro processors your company needs for the next five years. (Hint: Do not incorporate any depreciation and tax expenses) Year 1 Year 2 Year 3 152,000 345,000 267,000 Year 4 Year 5 498,000 734,000 a) (7 points) Compute the equivalent annual cost of owning the equipment at an annual interest rate of 15%. b) (8 points) Compute the equivalent annual cost of operating the equipment at an annual interest rate of 15%. c) (10 points) Assume that a third party producer offers to supply required amount of micro processors at a unit price of $1.08. Calculate equivalent cost of producing one unit at an annual interest rate of 15%. Which option is economically more profitable for your company, making or buying micro processors? Question 3. (25 points) You are working for a mobile phone producer and your company needs micro processors to be used in their final products for the next five years. The production line requires an initial investment of $1,350,000 now and at the end of the fifth year, you can sell the equipment at a price of $125,000. Fixed operating cost of the equipment is $15,000 in year 1 and increases by 5% in each subsequent year. Variable cost of producing a single micro processor is $0.12 in the first year and increases by 5% in each subsequent year. The following table summarizes number of micro processors your company needs for the next five years. (Hint: Do not incorporate any depreciation and tax expenses) Year 1 Year 2 Year 3 152,000 345,000 267,000 Year 4 Year 5 498,000 734,000 a) (7 points) Compute the equivalent annual cost of owning the equipment at an annual interest rate of 15%. b) (8 points) Compute the equivalent annual cost of operating the equipment at an annual interest rate of 15%. c) (10 points) Assume that a third party producer offers to supply required amount of micro processors at a unit price of $1.08. Calculate equivalent cost of producing one unit at an annual interest rate of 15%. Which option is economically more profitable for your company, making or buying micro processors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts