Question: Question 3: 3. A security is currently trading at $96. It will pay a coupon of $4 in three months. No other payouts are expected

Question 3:

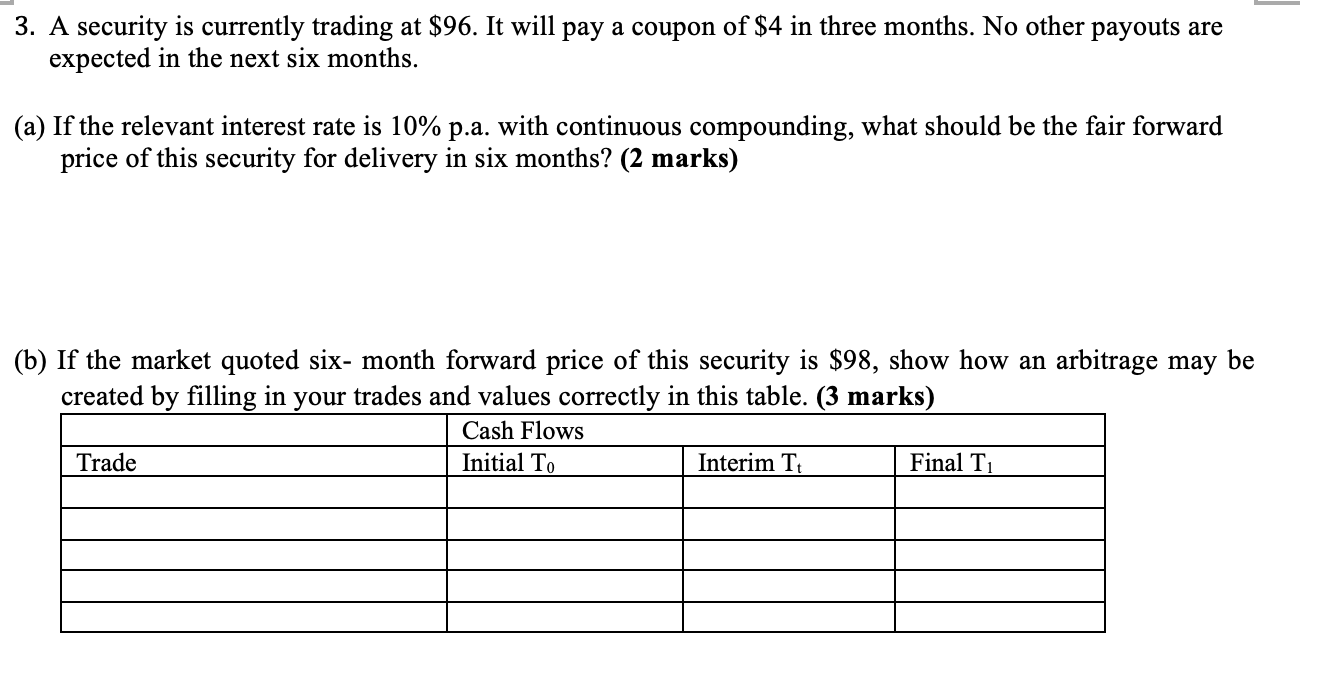

3. A security is currently trading at $96. It will pay a coupon of $4 in three months. No other payouts are expected in the next six months. (a) If the relevant interest rate is 10% pa. with continuous compounding, what should be the fair forward price of this security for delivery in six months? (2 marks) (b) If the market quoted six month forward price of this security is $98, show how an arbitrage may be created by lling in your trades and values correctly in this table. (3 marks) Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts