Question: Question 3 5 pts Consider an 15 year 12.5 % coupon bond with $ 1,000 par selling for $ 1,013 (semi-annual coupons). $Suppose that the

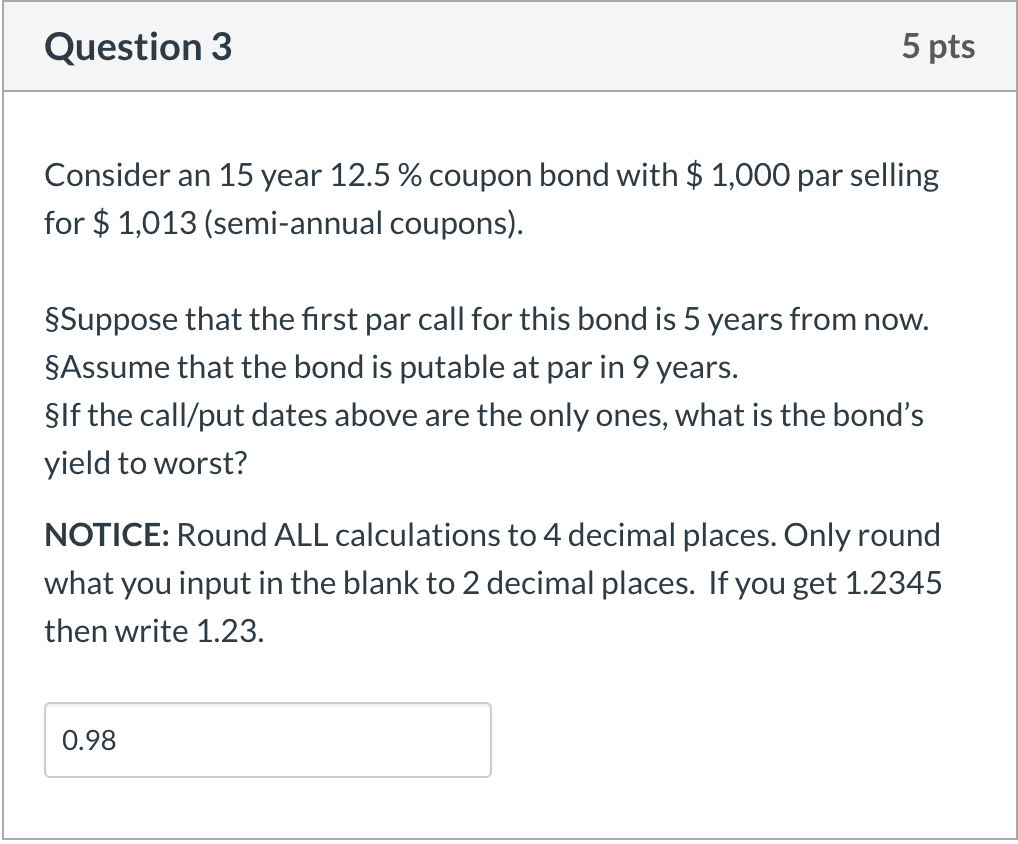

Question 3 5 pts Consider an 15 year 12.5 % coupon bond with $ 1,000 par selling for $ 1,013 (semi-annual coupons). $Suppose that the first par call for this bond is 5 years from now. Assume that the bond is putable at par in 9 years. $If the call/put dates above are the only ones, what is the bond's yield to worst? NOTICE: Round ALL calculations to 4 decimal places. Only round what you input in the blank to 2 decimal places. If you get 1.2345 then write 1.23. 0.98

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock