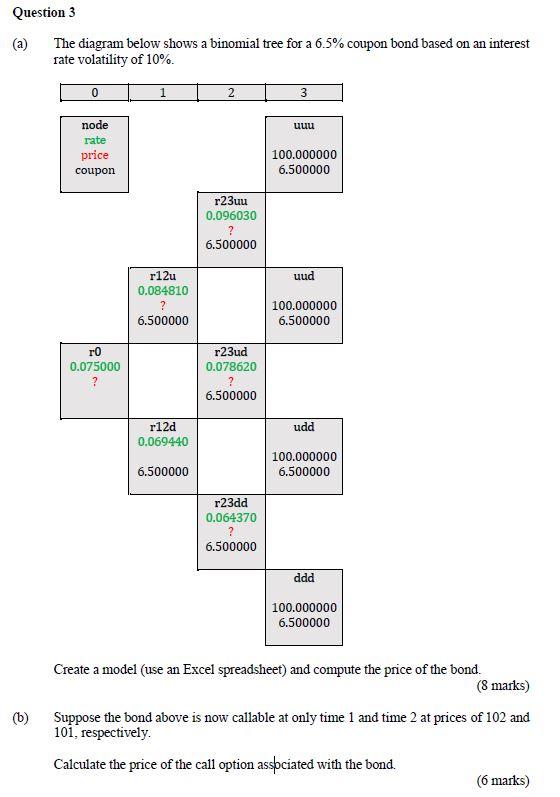

Question: Question 3 (a) The diagram below shows a binomial tree for a 6.5% coupon bond based on an interest rate volatility of 10% 2 3

Question 3 (a) The diagram below shows a binomial tree for a 6.5% coupon bond based on an interest rate volatility of 10% 2 3 uuu node rate price coupon 100.000000 6.500000 r23uu 0.096030 ? 6.500000 uud r12u 0.084810 ? 6.500000 100.000000 6.500000 ro 0.075000 ? r23ud 0.078620 ? 6.500000 udd r12d 0.069440 100.000000 6.500000 6.500000 r23dd 0.064370 ? 6.500000 ddd 100.000000 6.500000 (6) Create a model (use an Excel spreadsheet) and compute the price of the bond. (8 marks) Suppose the bond above is now callable at only time 1 and time 2 at prices of 102 and 101, respectively. Calculate the price of the call option associated with the bond. (6 marks) Question 3 (a) The diagram below shows a binomial tree for a 6.5% coupon bond based on an interest rate volatility of 10% 2 3 uuu node rate price coupon 100.000000 6.500000 r23uu 0.096030 ? 6.500000 uud r12u 0.084810 ? 6.500000 100.000000 6.500000 ro 0.075000 ? r23ud 0.078620 ? 6.500000 udd r12d 0.069440 100.000000 6.500000 6.500000 r23dd 0.064370 ? 6.500000 ddd 100.000000 6.500000 (6) Create a model (use an Excel spreadsheet) and compute the price of the bond. (8 marks) Suppose the bond above is now callable at only time 1 and time 2 at prices of 102 and 101, respectively. Calculate the price of the call option associated with the bond. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts