Question: Question 3 a) You intend to construct a 2-asset portfolio. Three stock candidates are available with the following probability distribution of their returns: Probability Return

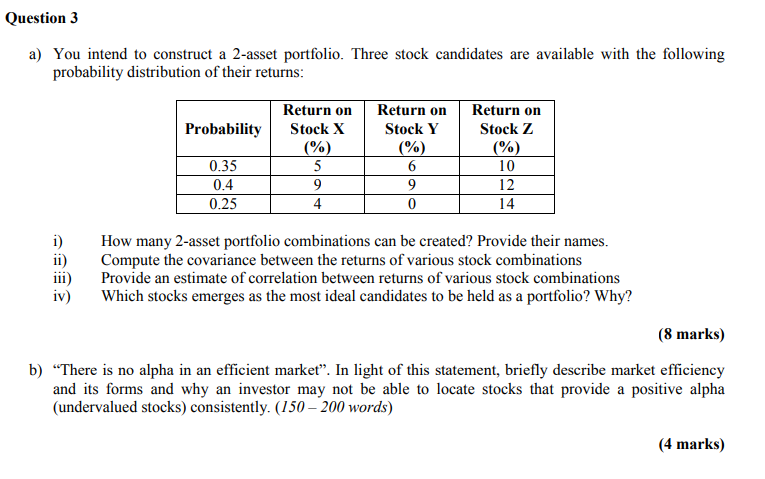

Question 3 a) You intend to construct a 2-asset portfolio. Three stock candidates are available with the following probability distribution of their returns: Probability Return on Stock X (%) 5 9 4 Return on Stock Y (%) 6 9 0 Return on Stock Z (%) 10 12 14 0.35 0.4 0.25 i) How many 2-asset portfolio combinations can be created? Provide their names. ii) Compute the covariance between the returns of various stock combinations Provide an estimate of correlation between returns of various stock combinations iv) Which stocks emerges as the most ideal candidates to be held as a portfolio? Why? (8 marks) b) There is no alpha in an efficient market. In light of this statement, briefly describe market efficiency and its forms and why an investor may not be able to locate stocks that provide a positive alpha (undervalued stocks) consistently. (150 - 200 words) (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts