Question: Question 3 Bond pricing a. Present and explain the formula you would use for pricing a bond. b. Consider a bond with a maturity of

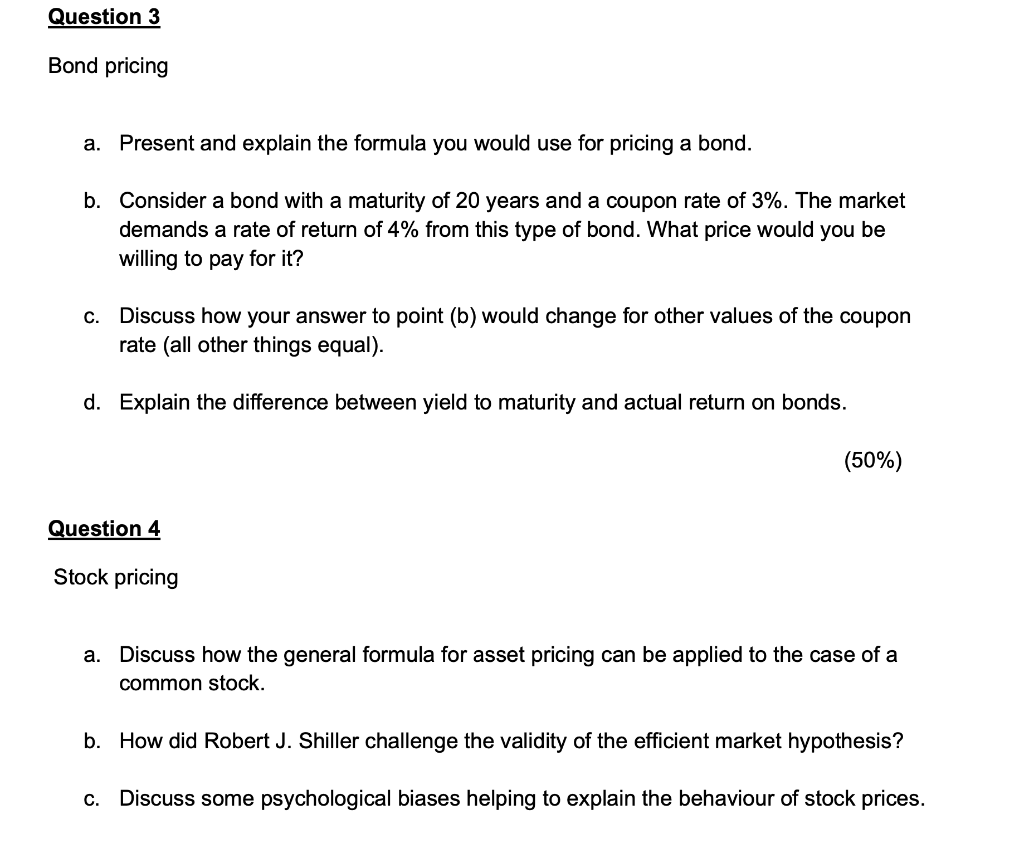

Question 3 Bond pricing a. Present and explain the formula you would use for pricing a bond. b. Consider a bond with a maturity of 20 years and a coupon rate of 3%. The market demands a rate of return of 4% from this type of bond. What price would you be willing to pay for it? c. Discuss how your answer to point (b) would change for other values of the coupon rate (all other things equal). d. Explain the difference between yield to maturity and actual return on bonds. (50%) Question 4 Stock pricing a. Discuss how the general formula for asset pricing can be applied to the case of a common stock. b. How did Robert J. Shiller challenge the validity of the efficient market hypothesis? c. Discuss some psychological biases helping to explain the behaviour of stock prices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts