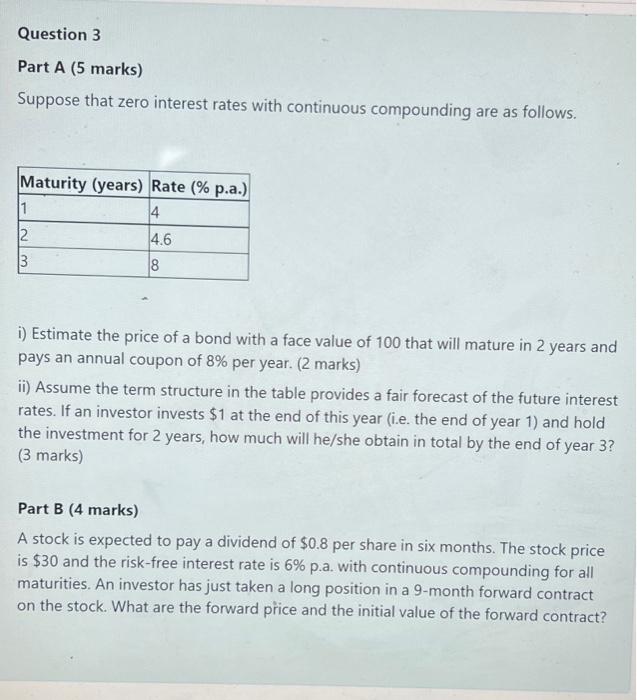

Question: Question 3 Part A (5 marks) Suppose that zero interest rates with continuous compounding are as follows. Maturity (years) Rate (% p.a.) 1 4 4.6

Question 3 Part A (5 marks) Suppose that zero interest rates with continuous compounding are as follows. Maturity (years) Rate (% p.a.) 1 4 4.6 3 8 i) Estimate the price of a bond with a face value of 100 that will mature in 2 years and pays an annual coupon of 8% per year. (2 marks) ii) Assume the term structure in the table provides a fair forecast of the future interest rates. If an investor invests $1 at the end of this year (i.e. the end of year 1) and hold the investment for 2 years, how much will he/she obtain in total by the end of year 3? (3 marks) Part B (4 marks) A stock is expected to pay a dividend of $0.8 per share in six months. The stock price is $30 and the risk-free interest rate is 6% p.a. with continuous compounding for all maturities. An investor has just taken a long position in a 9-month forward contract on the stock. What are the forward price and the initial value of the forward contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts