Question: Question 3-- Please help me to answer as soon as possible. Thanks for your help! Question 3 (30 marks) Stock Name Beta Expected Return Standard

Question 3-- Please help me to answer as soon as possible. Thanks for your help!

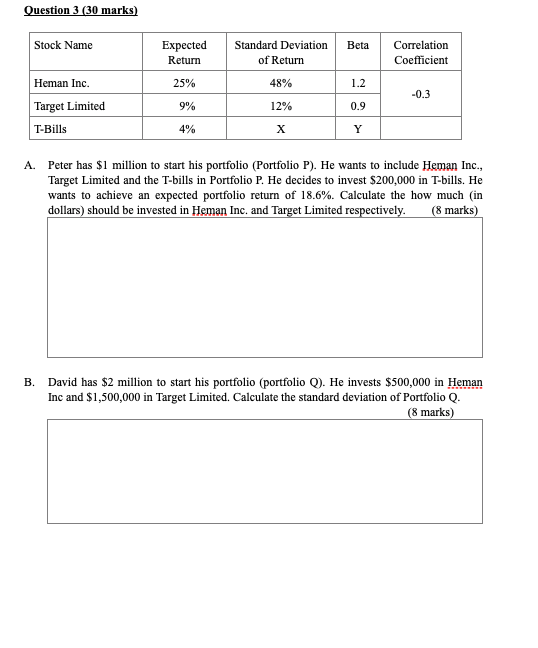

Question 3 (30 marks) Stock Name Beta Expected Return Standard Deviation of Return Correlation Coefficient Heman Inc. 25% 48% 1.2 -0.3 9% 12% 0.9 Target Limited T-Bills 4% x Y A. Peter has $1 million to start his portfolio (Portfolio P). He wants to include Heman Inc., Target Limited and the T-bills in Portfolio P. He decides to invest $200,000 in T-bills. He wants to achieve an expected portfolio return of 18.6%. Calculate the how much (in dollars) should be invested in Heman Inc. and Target Limited respectively. (8 marks) B. David has $2 million to start his portfolio (portfolio Q). He invests $500,000 in Heman Inc and $1,500,000 in Target Limited. Calculate the standard deviation of Portfolio Q. (8 marks) C. Further to part B, calculate the portfolio beta of portfolio Q. (4 marks) D. What are the values of X and Y in the table? (4 marks) E. Calculate the slope of the capital allocation line formed by Heman Inc. and the T-Bills. (6 marks) *** End of Paper ***

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts