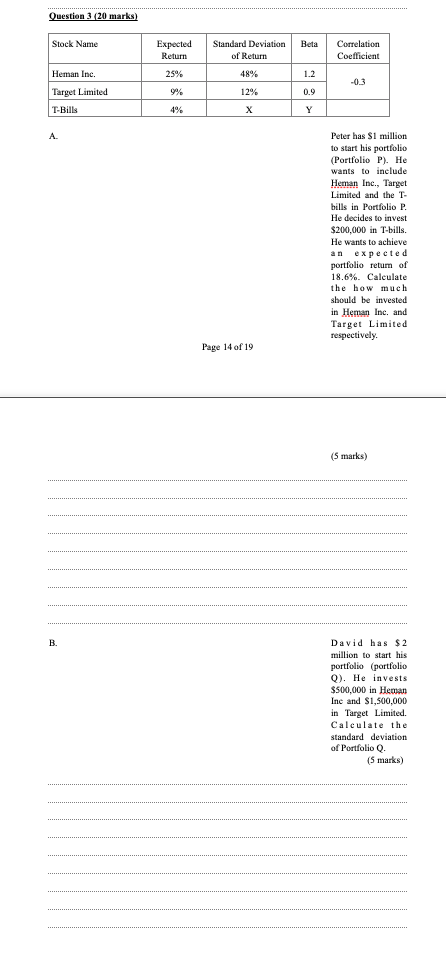

Question: Question 320 marks) Stock Name Beta Expected Return 25% Standard Deviation of Return Correlation Coefficient Heman Inc. 48% 1.2 -0.3 9% 12% 0.9 Target Limited

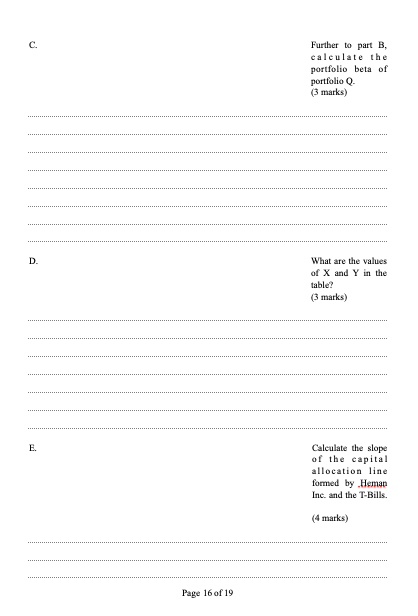

Question 320 marks) Stock Name Beta Expected Return 25% Standard Deviation of Return Correlation Coefficient Heman Inc. 48% 1.2 -0.3 9% 12% 0.9 Target Limited T-Bills 4% Y A. Peter has $1 million to start his portfolio (Portfolio P). He wants to include Heman Inc., Target Limited and the T- bills in Portfolio P. He decides to invest $200,000 in T-bills. He wants to achieve an expected portfolio retum of 18.6%. Calculate the how much should be invested in Hemen Inc. and Target Limited respectively. Page 14 of 19 (5 marks) (5 marks) B David has $2 million to start his portfolio (portfolio O). He invests $500,000 in Heman Inc and $1,500,000 in Target Limited. Calculate the standard deviation of Portfolio Q. (5 marks) c. Further to part B. calculate the portfolio beta of portfolio o (3 marks) D. What are the values of X and Y in the table? (3 marks) E. Calculate the slope of the capital allocation line formed by Heman Inc. and the T-Bills. (4 marks) Page 16 of 19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts