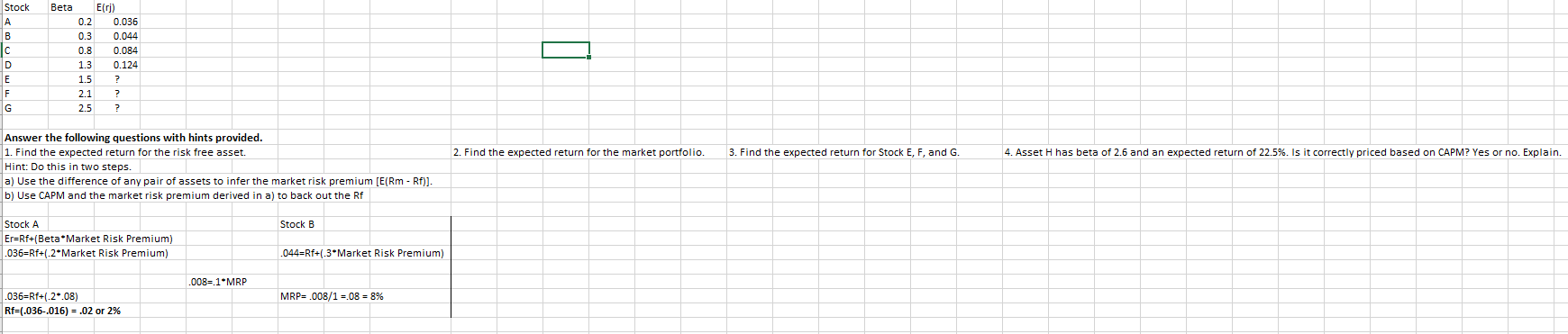

Question: QUESTION 3 PLEASE! Stock Beta E(rj) A 0.2 0.036 B 0.3 0.044 C 0.8 0.084 D 1.3 0.124 E 1.5 ? F 2.1 ? G

QUESTION 3 PLEASE!

QUESTION 3 PLEASE!

| Stock | Beta | E(rj) |

| A | 0.2 | 0.036 |

| B | 0.3 | 0.044 |

| C | 0.8 | 0.084 |

| D | 1.3 | 0.124 |

| E | 1.5 | ? |

| F | 2.1 | ? |

| G | 2.5 | ? |

| 3. Find the expected return for Stock E, F, and G. |

Beta Elri) 0.036 Stock A B 1 O 0.2 0.3 0.8 1.3 1.5 2.1 2.5 0.044 0.084 0.124 9 2 F F 2. Find the expected return for the market portfolio. 3. Find the expected return for Stock E, F, and G. 4. Asset H has beta of 2.6 and an expected return of 22.5%. Is it correctly priced based on CAPM? Yes or no. Explain. Answer the following questions with hints provided. 1. Find the expected return for the risk free asset. Hint: Do this in two steps. a) Use the difference of any pair of assets to infer the market risk premium [E(Rm - Rf)]. b) Use CAPM and the market risk premium derived in a) to back out the Rf Stock B Stock A Er=Rf+(Beta Market Risk Premium) .036=Rf+.2*Market Risk Premium) .044=Rf+(-3*Market Risk Premium) .008= 1*MRP MRP= .008/1 =.08 = 8% .036=Rf+.20.08) Rf=(.036-016) = .02 or 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts