Question: Question 3 (Total 24 points) * You are provided with the following table for assumptions of Beta Inc.'s financial forecas and valuation Assumptions for financial

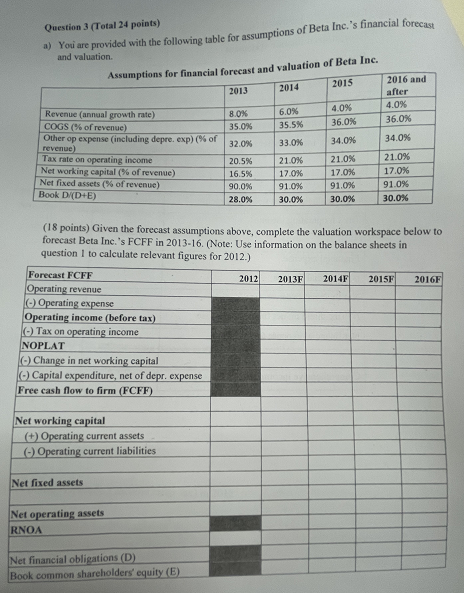

Question 3 (Total 24 points) * You are provided with the following table for assumptions of Beta Inc.'s financial forecas and valuation Assumptions for financial forecast and valuation of Beta Inc. 2015 2016 and 2013 2014 after Revenue (annual growth rate) 8.0% 6.0% 4.0% 4.0% COGS (% of revenue) 35.0% 35.5% 36.0% 36.0% Other op expense (including depre. exp) (% of revenue) 32.0% 33.0% 34.0% 34.0% Tax rate on operating income 20.5% 21.0% 21.0% 21.0% Net working capital (% of revenue) 16.5% 17.0% 17.0% 17.0% Net fixed assets (% of revenue) 90.0% 91.0% Book D ( DE) 91.0% 91.0% 28.0% 30.0% 30.0% 30.0% (18 points) Given the forecast assumptions above, complete the valuation workspace below to forecast Beta Inc.'s FCFF in 2013-16. (Note: Use information on the balance sheets in question I to calculate relevant figures for 2012.) Forecast FCFF 2012 2013F 2014F 2015F 2016F Operating revenue Operating expense Operating income (before tax) ke Tax on operating income NOPLAT Change in net working capital .) Capital expenditure, net of depr. expense Free cash flow to firm (FCFF) Net working capital (+) Operating current assets () Operating current liabilities Net fixed assets Net operating assets RNOA Net financial obligations (D) Book common shareholders' equity (E) Question 3 (Total 24 points) * You are provided with the following table for assumptions of Beta Inc.'s financial forecas and valuation Assumptions for financial forecast and valuation of Beta Inc. 2015 2016 and 2013 2014 after Revenue (annual growth rate) 8.0% 6.0% 4.0% 4.0% COGS (% of revenue) 35.0% 35.5% 36.0% 36.0% Other op expense (including depre. exp) (% of revenue) 32.0% 33.0% 34.0% 34.0% Tax rate on operating income 20.5% 21.0% 21.0% 21.0% Net working capital (% of revenue) 16.5% 17.0% 17.0% 17.0% Net fixed assets (% of revenue) 90.0% 91.0% Book D ( DE) 91.0% 91.0% 28.0% 30.0% 30.0% 30.0% (18 points) Given the forecast assumptions above, complete the valuation workspace below to forecast Beta Inc.'s FCFF in 2013-16. (Note: Use information on the balance sheets in question I to calculate relevant figures for 2012.) Forecast FCFF 2012 2013F 2014F 2015F 2016F Operating revenue Operating expense Operating income (before tax) ke Tax on operating income NOPLAT Change in net working capital .) Capital expenditure, net of depr. expense Free cash flow to firm (FCFF) Net working capital (+) Operating current assets () Operating current liabilities Net fixed assets Net operating assets RNOA Net financial obligations (D) Book common shareholders' equity (E)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts