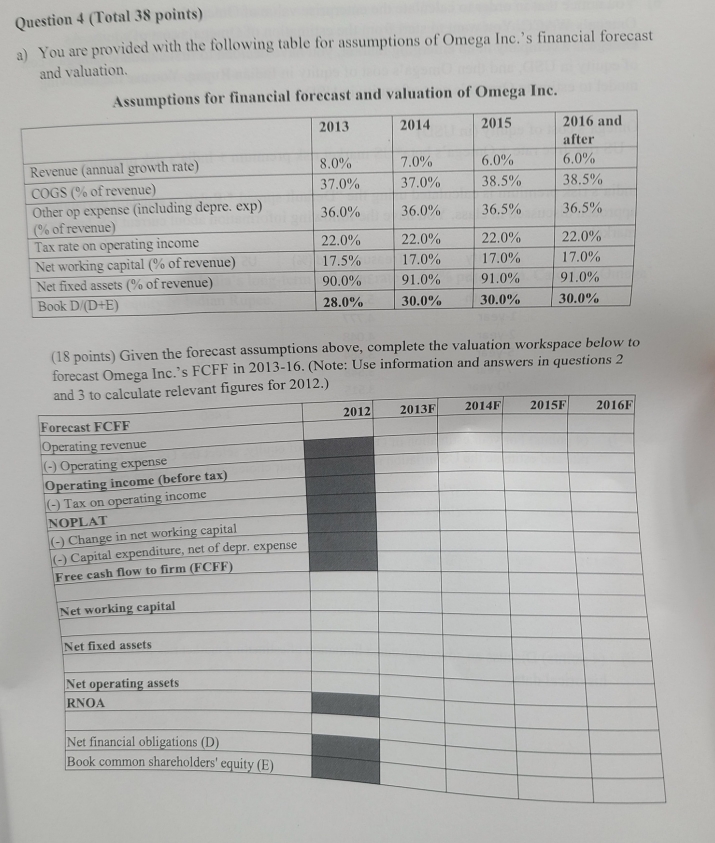

Question: Question 4 ( Total 3 8 points ) a ) You are provided with the following table for assumptions of Omega Inc. ' s financial

Question Total points a You are provided with the following table for assumptions of Omega Inc.s financial forecast and valuation. Assumptions for financial forecast and valuation of Omega Inc and afterOther op expense including depre. exp of revenue points Given the forecast assumptions above, complete the valuation workspace below to forecast Omega Inc.s FCFF in Note: Use information and answers in questions and to calculate relevant figures for Capital expenditure, net of depr. expense b You notice that in order to calculate the enterprise value of Omega Inc., you need to estimate Omega's WACC. You want to start from the estimation of Omega's cost of equity. As Omega is a company in an emerging market, you have decided to first calculate Omega's cost of equity in USD, and then Omega's cost of equity in Indian Rupee. You use the following model to estimate Omega's cost of equity in USD:

Omega's cost of equity in USD

US riskfree rate Omega's betaUS market risk premium India's risk premium

India's risk premium is calculated using the "Default spread Relative standard deviations" approach discussed in class. You have the following information about current US Treasury markets:

i points For your estimation of Omega's cost of equity, select the US riskfree interest rate and estimate the US inflation rate. Explain your choice and calculation carefully.

ii points Discuss an advantage and a limitation of estimating market risk premium using historical data. iii points Suppose the US market risk premium is Omega's beta is the standard deviation in the Indian equity market is the standard deviation in the Indian's bond is and India's sovereign CDS spread is basis points. Calculate Omega's cost of equity in USD

iv points Suppose India's longterm inflation rate is per annum. Calculate Omega' cost of equity in Indian Rupee.

c points Suppose you are at the beginning of Omega's WACC is estimated to be Given your FCFF forecast in part a calculate the equity value of Omega Inc. by completing the workspace below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock