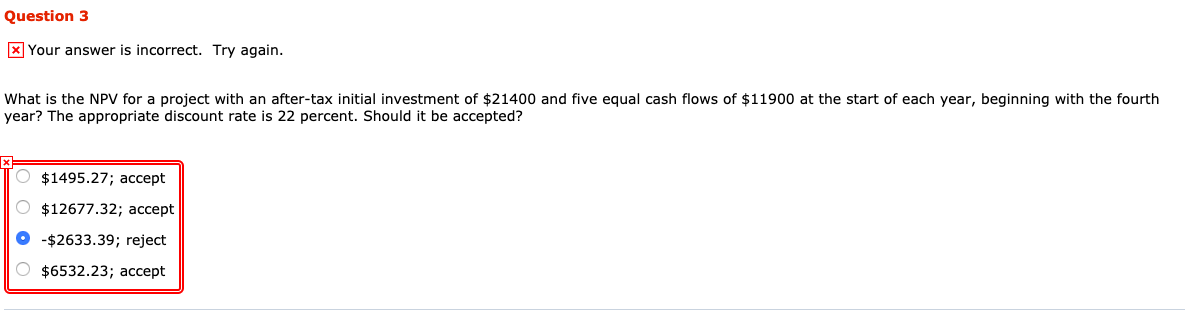

Question: Question 3 x Your answer is incorrect. Try again. What is the NPV for a project with an after-tax initial investment of $21400 and five

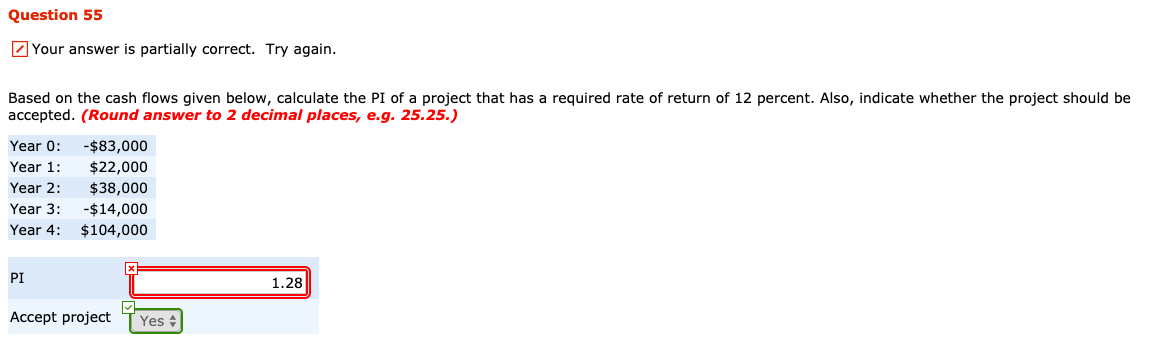

Question 3 x Your answer is incorrect. Try again. What is the NPV for a project with an after-tax initial investment of $21400 and five equal cash flows of $11900 at the start of each year, beginning with the fourth year? The appropriate discount rate is 22 percent. Should it be accepted? | O $1495.27; accept $12677.32; accept -$2633.39; reject O $6532.23; accept Question 55 Your answer is partially correct. Try again. Based on the cash flows given below, calculate the PI of a project that has a required rate of return of 12 percent. Also, indicate whether the project should be accepted. (Round answer to 2 decimal places, e.g. 25.25.) Year 0: Year 1: Year 2: Year 3: Year 4: $83,000 $22,000 $38,000 $14,000 $104,000 PI 1.28 Accept project 1 Yes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts