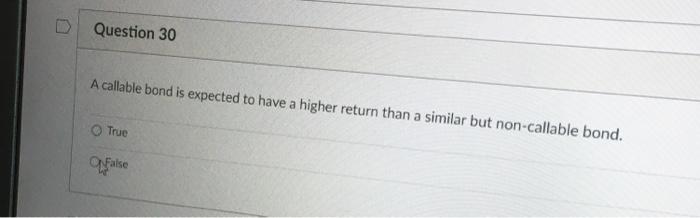

Question: Question 30 A callable bond is expected to have a higher return than a similar but non-callable bond. True False Question 31 The relationship between

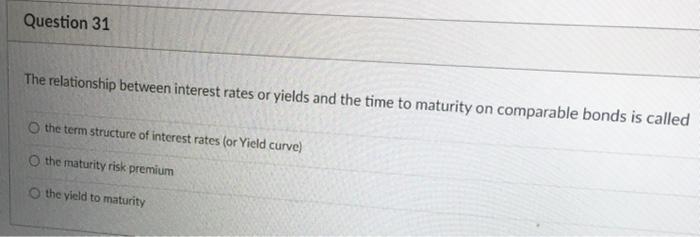

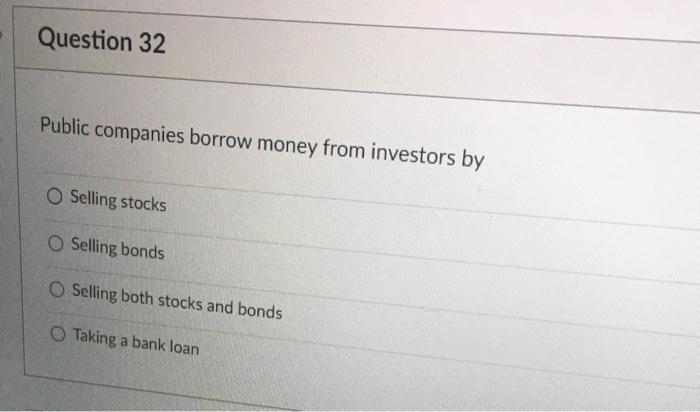

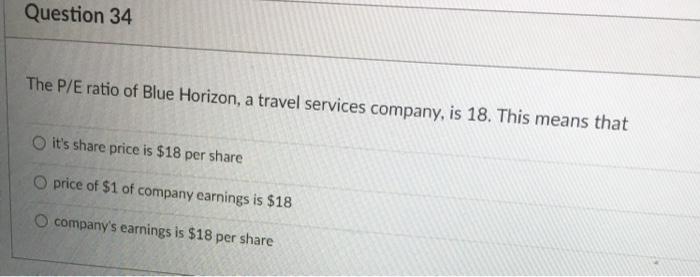

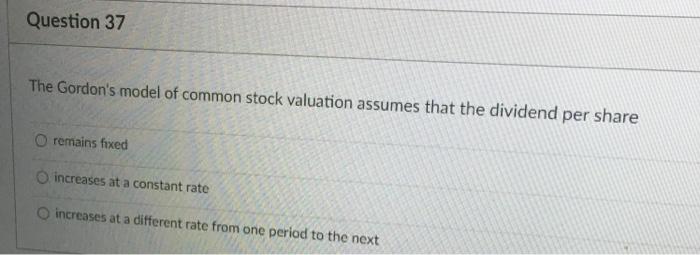

Question 30 A callable bond is expected to have a higher return than a similar but non-callable bond. True False Question 31 The relationship between interest rates or yields and the time to maturity on comparable bonds is called the term structure of interest rates for Yield curve) the maturity risk premium the yield to maturity Question 32 Public companies borrow money from investors by O Selling stocks Selling bonds Selling both stocks and bonds Taking a bank loan Question 34 The P/E ratio of Blue Horizon, a travel services company, is 18. This means that it's share price is $18 per share price of $1 of company earnings is $18 O company's earnings is $18 per share Question 37 The Gordon's model of common stock valuation assumes that the dividend per share O remains fixed increases at a constant rate increases at a different rate from one period to the next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts