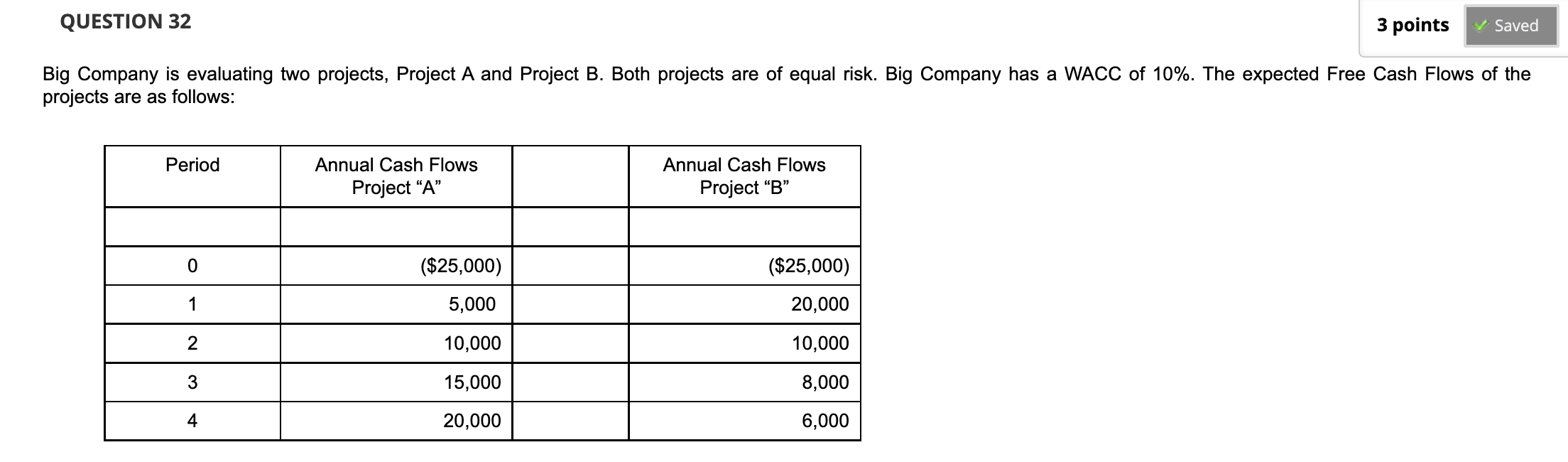

Question: QUESTION 32 3 points Saved Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has

QUESTION 32 3 points Saved Big Company is evaluating two projects, Project A and Project B. Both projects are of equal risk. Big Company has a WACC of 10%. The expected Free Cash Flows of the projects are as follows: Period Annual Cash Flows Project A Annual Cash Flows Project B 0 ($25,000) ($25,000) 1 5,000 20,000 2 10,000 10,000 3 15,000 8,000 4 20,000 6,000 QUESTION 34 3 points Save Answer The Modified Internal Rate of Return of Project B is 20.96%. If Projects A and B are mutually exclusive, considering only the MIRR method, which project(s) should Big Company proceed with? Explain your answer. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U Paragraph Arial 10pt A TE Q ili ... s o = = = X2 X2 > TT ABC [+ 1 V 22 [x] - EX: i {} Ra Ky # QUESTION 34 3 points Save Answer The Modified Internal Rate of Return of Project B is 20.96%. If Projects A and B are mutually exclusive, considering only the MIRR method, which project(s) should Big Company proceed with? Explain your answer. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B I U Paragraph Arial 10pt A TE Q ili ... s o = = = X2 X2 > TT ABC [+ 1 V 22 [x] - EX: i {} Ra Ky #

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts