Question: Question 32.1/30 Assignment sent to Gradebook. Your grade is being recorded. Fri, Jun 5, 2020, 6:39:17 PM (Asia/Nicosia +03:00) Prev Next Question 2 14.7/30 View

Question 32.1/30

Assignment sent to Gradebook. Your grade is being recorded.

Fri, Jun 5, 2020, 6:39:17 PM (Asia/Nicosia +03:00)

Prev

Next

Question 2

14.7/30

View Policies

Show Attempt History

Current Attempt in Progress

The following selected accounts from Highview Electronics Corporations general ledger are presented below for the year ended December 31, 2018:

| Accounts receivable | $276,000 | |

| Accumulated depreciationequipment | 771,000 | |

| Advertising expense | 52,000 | |

| Common shares | 246,000 | |

| Cost of goods sold | 1,057,000 | |

| Depreciation expense | 126,000 | |

| Dividends declared | 142,000 | |

| Equipment | 1,466,000 | |

| Freight out | 27,000 | |

| Income tax expense | 77,000 | |

| Insurance expense | 25,000 | |

| Interest expense | 59,000 | |

| Interest revenue | 32,000 | |

| Inventory | 95,000 | |

| Prepaid expenses | 28,000 | |

| Rent revenue | 21,000 | |

| Retained earnings | 568,000 | |

| Salaries expense | 663,000 | |

| Sales | 2,393,000 | |

| Sales discounts | 21,000 | |

| Sales returns and allowances | 40,000 | |

| Unearned revenue | 19,000 |

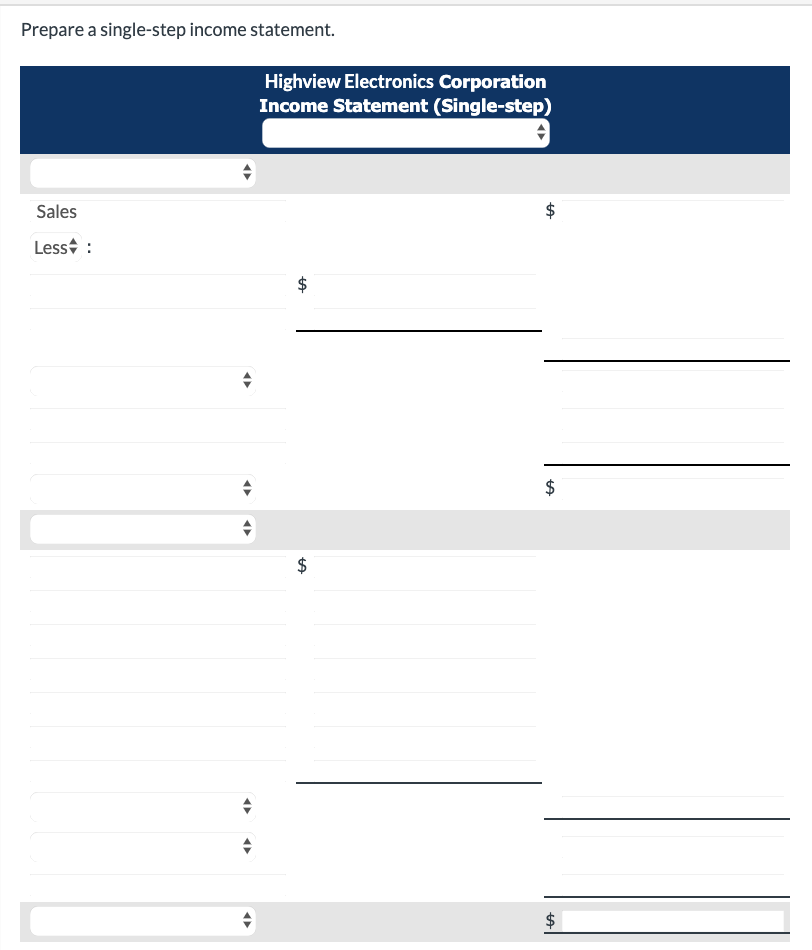

Prepare a single-step income statement. Highview Electronics Corporation Income Statement (Single-step) 4 Sales $ Less : $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts