Question: Question 39 1 pts Apple Inc. just signed a contract to buy memory chips from Samsung and was billed KRW500 million, payable in one year.

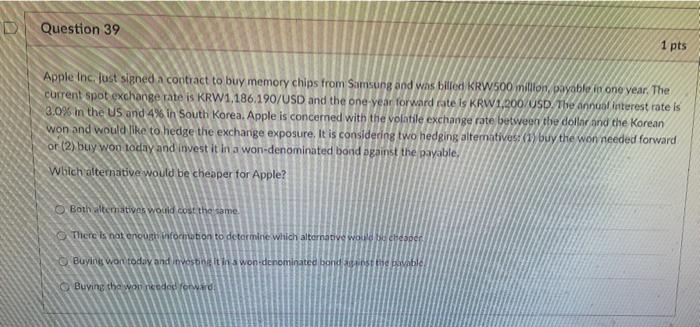

Question 39 1 pts Apple Inc. just signed a contract to buy memory chips from Samsung and was billed KRW500 million, payable in one year. The current spot exchange rate is KRW1.186.190/USD and the one-year forward rate is KRW 1,200/OSD. The anngof interest rate is 3,0% in the US and 4% in South Korea. Apple is concerned with the volatile exchange rate between the doll and the Korean won and would like to hedge the exchange exposure. It is considering two hedging alteratives: (1) buy the won needed forward or (2) buy won today and invest it in a won-denominated bond bgainst the payable, Which alternative would be cheaper for Apple? Both alternatives would cost the same There is not enough information to determine which alternative Woches de Buying won today and investing it in a won denominated bondine bevable o Buving the won needed forward

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts