Question: Question 4 ( 1 2 marks ) Module - 7 Face lovely Inc. sells face creams to worldwide. On December 1 , 2 0 2

Question marks Module

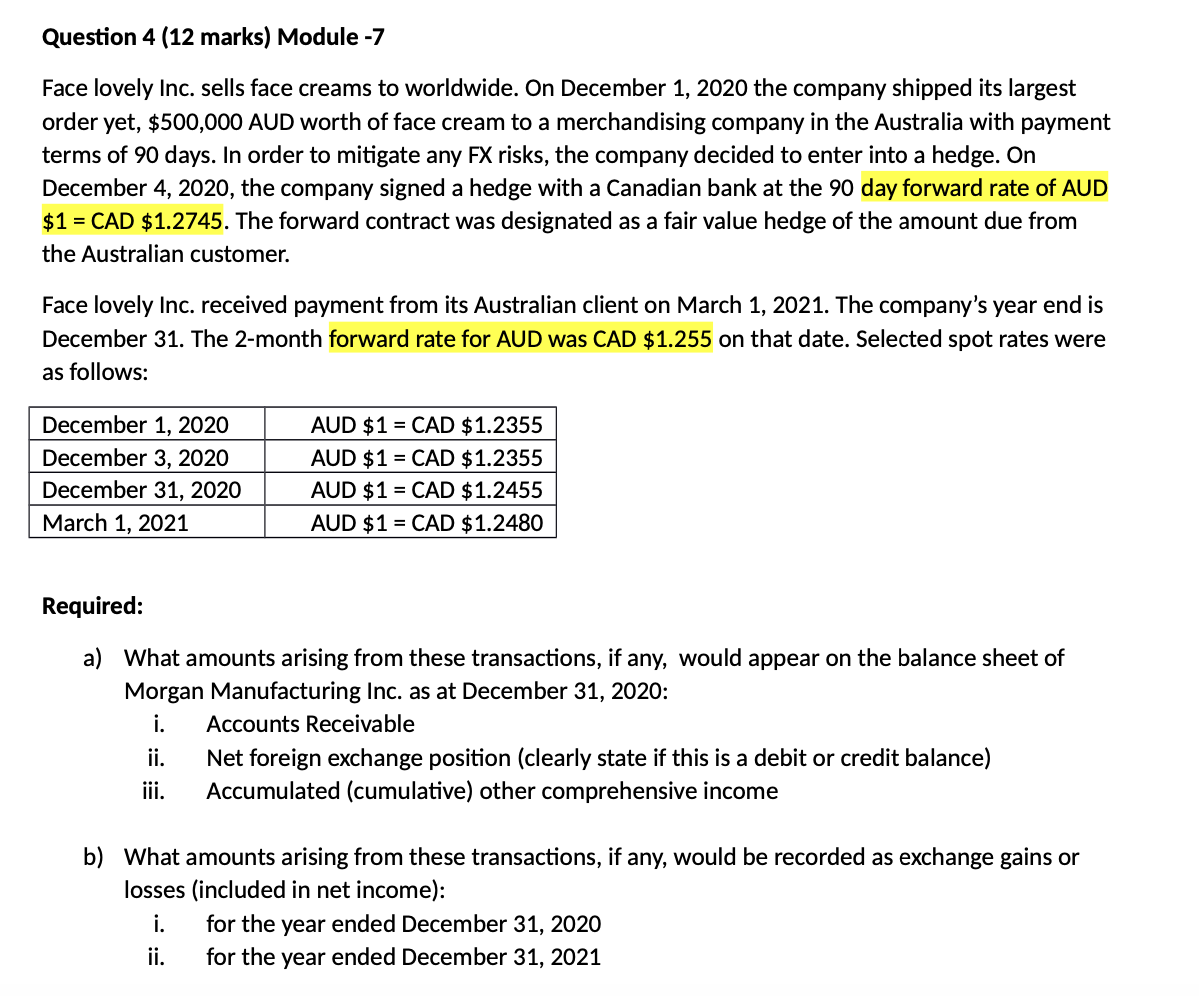

Face lovely Inc. sells face creams to worldwide. On December the company shipped its largest

order yet, $ AUD worth of face cream to a merchandising company in the Australia with payment

terms of days. In order to mitigate any FX risks, the company decided to enter into a hedge. On

December the company signed a hedge with a Canadian bank at the day forward rate of AUD

$ CAD $ The forward contract was designated as a fair value hedge of the amount due from

the Australian customer.

Face lovely Inc. received payment from its Australian client on March The company's year end is

December The month forward rate for AUD was CAD $ on that date. Selected spot rates were

as follows:

Required:

a What amounts arising from these transactions, if any, would appear on the balance sheet of

Morgan Manufacturing Inc. as at December :

i Accounts Receivable

ii Net foreign exchange position clearly state if this is a debit or credit balance

iii. Accumulated cumulative other comprehensive income

b What amounts arising from these transactions, if any, would be recorded as exchange gains or

losses included in net income:

i for the year ended December

ii for the year ended December

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock