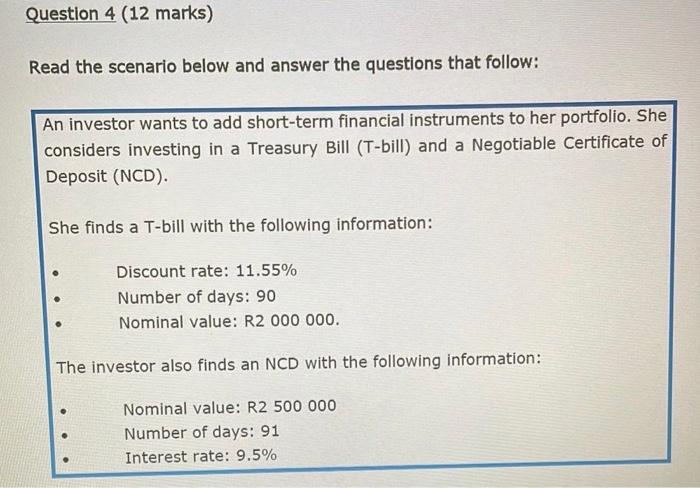

Question: Question 4 (12 marks) Read the scenario below and answer the questions that follow: An investor wants to add short-term financial instruments to her portfolio.

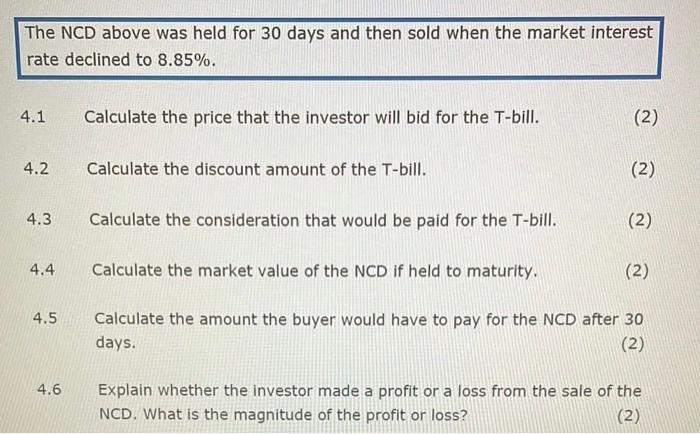

Question 4 (12 marks) Read the scenario below and answer the questions that follow: An investor wants to add short-term financial instruments to her portfolio. She considers investing in a Treasury Bill (T-bill) and a Negotiable Certificate of Deposit (NCD). She finds a T-bill with the following information: Discount rate: 11.55% Number of days: 90 Nominal value: R2 000 000. The investor also finds an NCD with the following information: Nominal value: R2 500 000 Number of days: 91 Interest rate: 9.5% The NCD above was held for 30 days and then sold when the market interest rate declined to 8.85%. 4.1 Calculate the price that the investor will bid for the T-bill. (2) 4.2 Calculate the discount amount of the T-bill. (2) 4.3 Calculate the consideration that would be paid for the T-bill. (2) 4.4 Calculate the market value of the NCD if held to maturity. (2) 4.5 Calculate the amount the buyer would have to pay for the NCD after 30 days. (2) 4.6 Explain whether the investor made a profit or a loss from the sale of the NCD. What is the magnitude of the profit or loss? (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts