Question: Question 4 (6 marks) Read the scenario below and answer the questions that follow: An investor is tracking Company C and D, which he intends

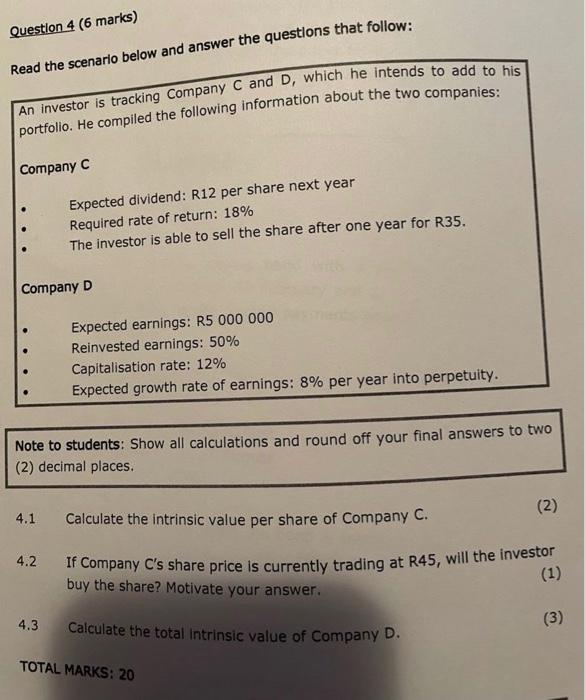

Question 4 (6 marks) Read the scenario below and answer the questions that follow: An investor is tracking Company C and D, which he intends to add to his portfolio . He compiled the following information about the two companies: Company C Expected dividend: R12 per share next year Required rate of return: 18% The investor is able to sell the share after one year for R35. Company D Expected earnings: R5 000 000 Reinvested earnings: 50% Capitalisation rate: 12% Expected growth rate of earnings: 8% per year into perpetuity. Note to students: Show all calculations and round off your final answers to two (2) decimal places. (2) 4.1 Calculate the intrinsic value per share of Company C. 4.2 If Company C's share price is currently trading at R45, will the investor (1) buy the share? Motivate your answer. 4.3 Calculate the total intrinsic value of Company D. (3) TOTAL MARKS: 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts