Question: Question 4 (16 marks; 2 marks each) a) Alpha Ltd, incurred $204,000 of research costs, up to December 31, 2019, in its laboratory to develop

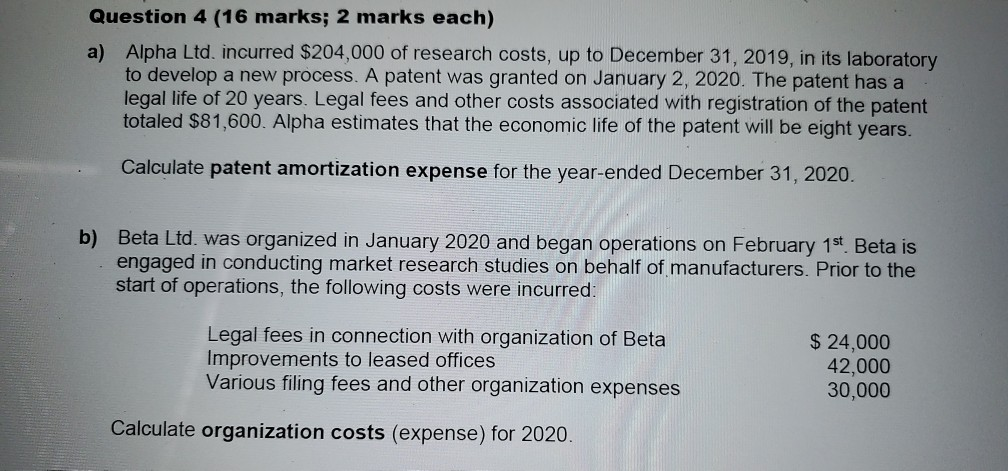

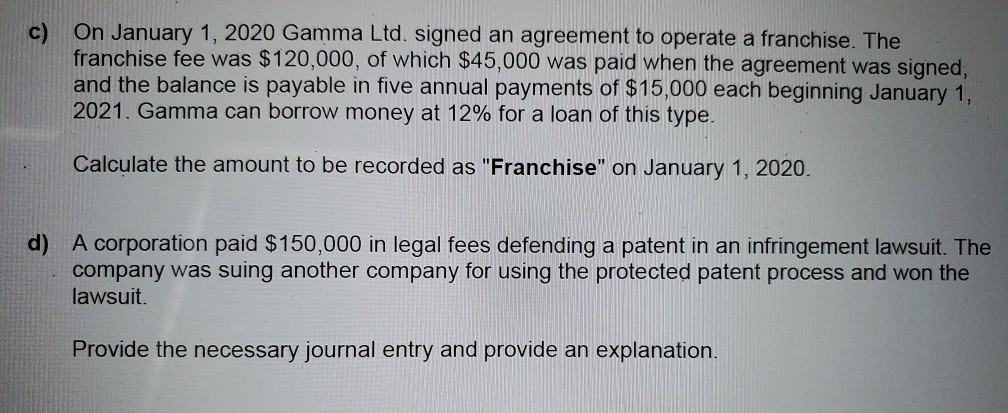

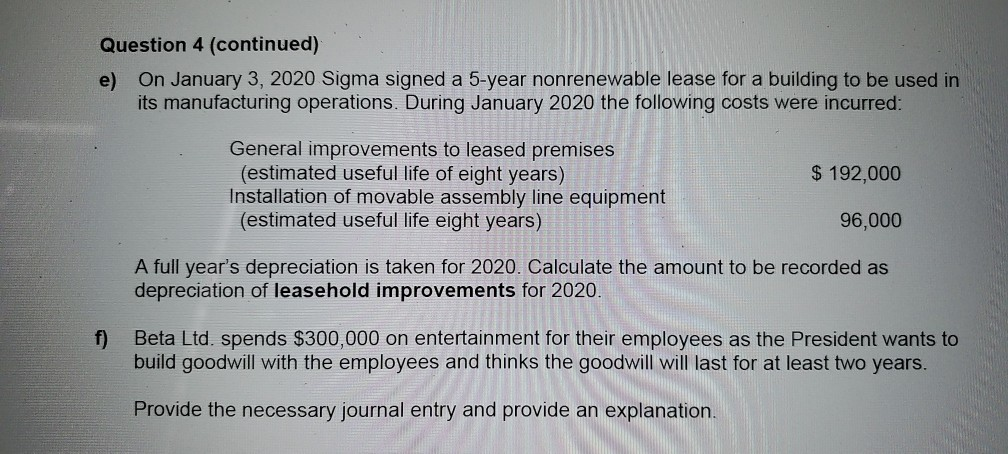

Question 4 (16 marks; 2 marks each) a) Alpha Ltd, incurred $204,000 of research costs, up to December 31, 2019, in its laboratory to develop a new process. A patent was granted on January 2, 2020. The patent has a legal life of 20 years. Legal fees and other costs associated with registration of the patent totaled $81,600. Alpha estimates that the economic life of the patent will be eight years. Calculate patent amortization expense for the year-ended December 31, 2020. b) Beta Ltd. was organized in January 2020 and began operations on February 1st. Beta is engaged in conducting market research studies on behalf of manufacturers. Prior to the start of operations, the following costs were incurred: Legal fees in connection with organization of Beta Improvements to leased offices Various filing fees and other organization expenses $ 24,000 42,000 30,000 Calculate organization costs (expense) for 2020. c) On January 1, 2020 Gamma Ltd. signed an agreement to operate a franchise. The franchise fee was $120,000, of which $45,000 was paid when the agreement was signed, and the balance is payable in five annual payments of $15,000 each beginning January 1, 2021. Gamma can borrow money at 12% for a loan of this type. Calculate the amount to be recorded as "Franchise" on January 1, 2020. d) A corporation paid $150,000 in legal fees defending a patent in an infringement lawsuit. The company was suing another company for using the protected patent process and won the lawsuit Provide the necessary journal entry and provide an explanation. Question 4 (continued) e) On January 3, 2020 Sigma signed a 5-year nonrenewable lease for a building to be used in its manufacturing operations. During January 2020 the following costs were incurred: General improvements to leased premises (estimated useful life of eight years) Installation of movable assembly line equipment (estimated useful life eight years) $ 192,000 96,000 A full year's depreciation is taken for 2020. Calculate the amount to be recorded as depreciation of leasehold improvements for 2020. Beta Ltd. spends $300,000 on entertainment for their employees as the President wants to build goodwill with the employees and thinks the goodwill will last for at least two years. Provide the necessary journal entry and provide an explanation. The following information is to be used for g) and h): Gamma uses ASPE and has two assets it is considering at its year end for impairments. The first, goodwill, was placed on the books at $75,000 five years ago and was written down due to impairment, 3-years ago, to $45,000. The second, a patent, has a cost of $66,000 and accumulative amortization of $24,000. The fair values are: goodwill $60,000; patent $30,000. The expected future net cash flows (undiscounted) for the patent are $36,000. g) Calculate the amount to be recorded as "Goodwill h) Calculate the net amount to be recorded as "Patent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts