Question: QUESTION 4 ( 2 5 marks ) Using the Projected Statement of Comprehensive Income and Projected Statement of Financial Position prepared in Questions 2 and

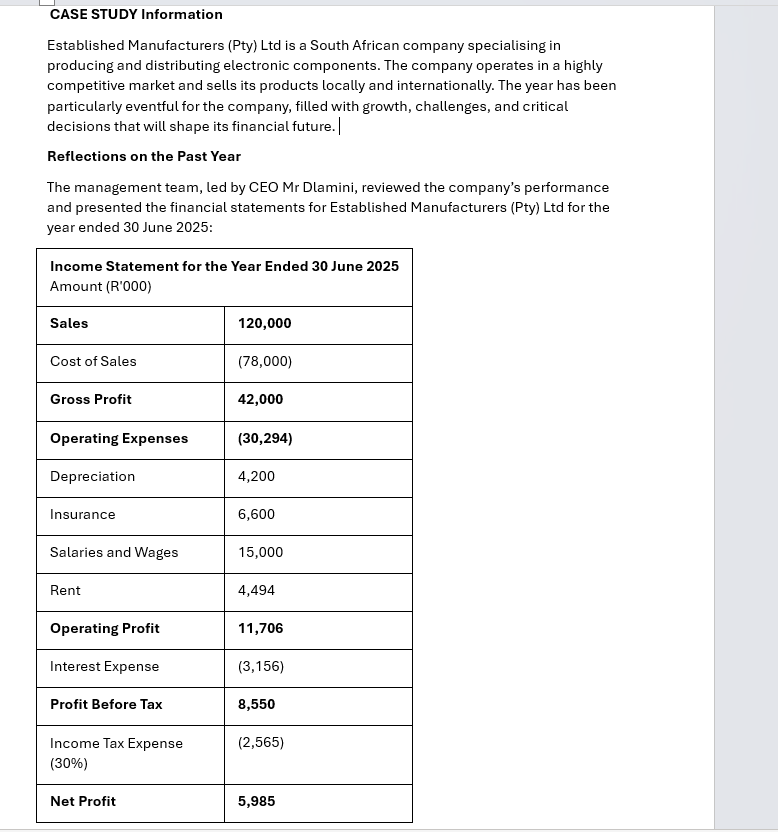

QUESTION marks Using the Projected Statement of Comprehensive Income and Projected Statement of Financial Position prepared in Questions and respectively, along with any other relevant information from the case study, calculate the following financial ratios for : Current Ratio marks AcidTest Ratio marks Net Profit Margin marks Return on Assets marks Return on Equity marks DebttoEquity Ratio marks Interest Coverage Ratio marks Creditors Collection Period marks Inventory turnover period marks Earnings per share marks Earnings retention ratio marks NB: Where applicable, answers must be rounded to two decimal places. The total interest expense for FYE is expected to rise by

Based on the review and discussion, the CFO projected an unfavourable bank balance of R at the end of October He also mentioned that given the loyalty and

support of the shareholders, it is anticipated a dividend of cents per share will be declared and paid out in the financial year. Established Manufacturers Pty Ltd has an authorised share capital of ordinary shares of which have been issued.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock