Question: QUESTION 4 (25 MARKS) a. SinChan Corporation has successfully secured two projects to supply tires to Kancil and Kenari Automotive. Below is the information on

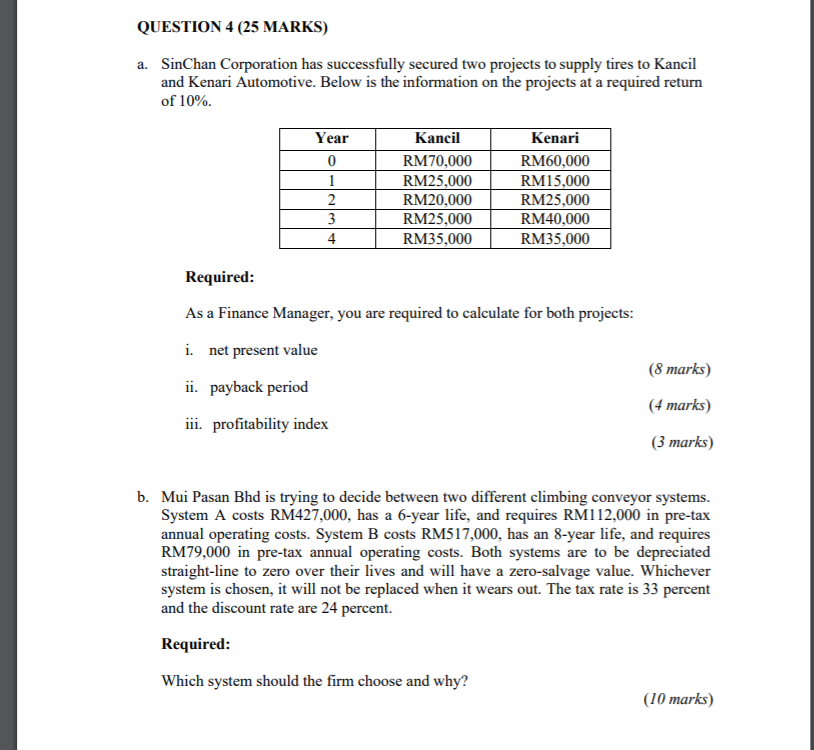

QUESTION 4 (25 MARKS) a. SinChan Corporation has successfully secured two projects to supply tires to Kancil and Kenari Automotive. Below is the information on the projects at a required return of 10%. Year 0 1 2 3 4 Kancil RM70,000 RM25,000 RM20,000 RM25,000 RM35,000 Kenari RM60,000 RM15,000 RM25,000 RM40,000 RM35,000 Required: As a Finance Manager, you are required to calculate for both projects: i. net present value ii. payback period (8 marks) (4 marks) iii. profitability index (3 marks) b. Mui Pasan Bhd is trying to decide between two different climbing conveyor systems. System A costs RM427,000, has a 6-year life, and requires RM112,000 in pre-tax annual operating costs. System B costs RM517,000, has an 8-year life, and requires RM79,000 in pre-tax annual operating costs. Both systems are to be depreciated straight-line to zero over their lives and will have a zero-salvage value. Whichever system is chosen, it will not be replaced when it wears out. The tax rate is 33 percent and the discount rate are 24 percent. Required: Which system should the firm choose and why? (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts