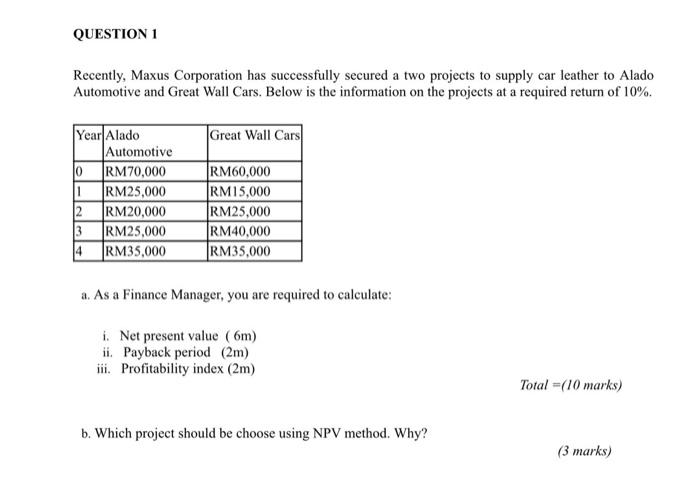

Question: QUESTION 1 Recently, Maxus Corporation has successfully secured a two projects to supply car leather to Alado Automotive and Great Wall Cars. Below is the

QUESTION 1 Recently, Maxus Corporation has successfully secured a two projects to supply car leather to Alado Automotive and Great Wall Cars. Below is the information on the projects at a required return of 10%. Great Wall Cars Year Alado Automotive 0 RM70,000 1RM25,000 2 RM20,000 13 RM25,000 4 RM35,000 RM60,000 RM15,000 RM25,000 RM40,000 RM35,000 a. As a Finance Manager, you are required to calculate: 1. Net present value 6m) ii. Payback period (2m) iii. Profitability index (2m) Total =(10 marks) b. Which project should be choose using NPV method. Why

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock