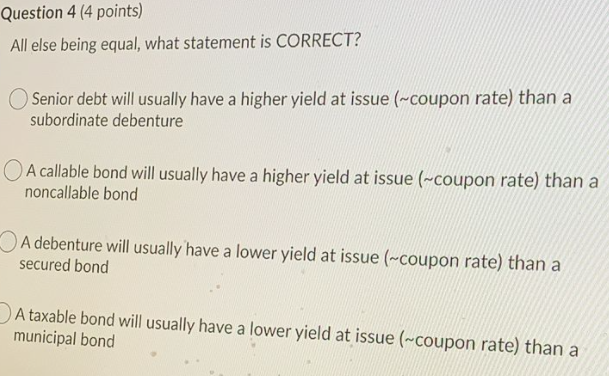

Question: Question 4 (4 points) All else being equal, what statement is CORRECT? Senior debt will usually have a higher yield at issue (~coupon rate) than

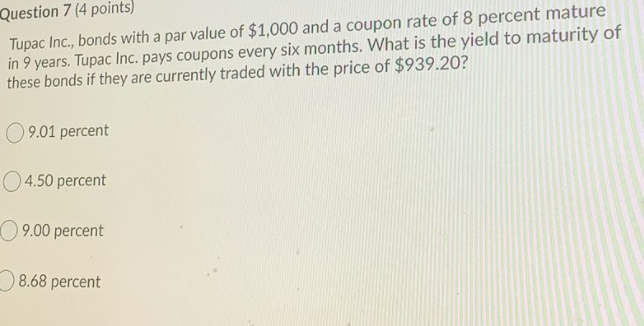

Question 4 (4 points) All else being equal, what statement is CORRECT? Senior debt will usually have a higher yield at issue (~coupon rate) than a subordinate debenture A callable bond will usually have a higher yield at issue (~coupon rate) than a noncallable bond A debenture will usually have a lower yield at issue (-coupon rate) than a secured bond a A taxable bond will usually have a lower yield at issue (~coupon rate) than a municipal bond Question 7 (4 points) Tupac Inc., bonds with a par value of $1,000 and a coupon rate of 8 percent mature in 9 years. Tupac Inc. pays coupons every six months. What is the yield to maturity of these bonds if they are currently traded with the price of $939.20? 9.01 percent 4.50 percent 09.00 percent 8.68 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts