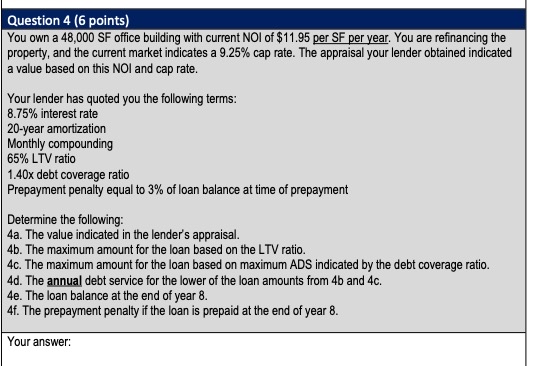

Question: Question 4 ( 6 points ) You own a 4 8 , 0 0 0 S F office building with current NOI of $ 1

Question points

You own a office building with current NOI of $ per per year. You are refinancing the property, and the current market indicates a cap rate. The appraisal your lender obtained indicated a value based on this NOI and cap rate.

Your lender has quoted you the following terms:

interest rate

year amortization

Monthly compounding

LTV ratio

x debt coverage ratio

Prepayment penalty equal to of loan balance at time of prepayment

Determine the following:

a The value indicated in the lender's appraisal.

b The maximum amount for the loan based on the LTV ratio.

c The maximum amount for the loan based on maximum ADS indicated by the debt coverage ratio.

d The annual debt service for the lower of the loan amounts from and

e The loan balance at the end of year

f The prepayment penalty if the loan is prepaid at the end of year

Your answer:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock