Question: QUESTION 4 (a) [ In lectures, we discussed several long/short strategies. One of these was the fixed income arbitrage strategy. List two other long/short strategies

QUESTION 4

(a) [ In lectures, we discussed several long/short strategies. One of these was

the fixed income arbitrage strategy. List two other long/short strategies that we

discussed in classes this semester.

(b) (i) Referring to the information above, explain how you would implement the

fixed income arbitrage strategy. Which bond would you take a long position in and which

bond would you take a short position in and why?

(b) (ii) [ You are working in a fixed income hedge fund and one of your colleagues

says that they would prefer the fund to take a long-only position to take advantage of the

situation shown in the table above. Carefully explain why your colleague might make this

suggestion?

(c) (i) ] Another of your colleagues suggests using leverage when implementing

the fixed income arbitrage strategy. Carefully explain why your colleague might suggest

using leverage.

(c) (ii) Carefully explain the benefits and the risks associated with using leverage

(in the fixed income arbitrage strategy).

(c) (iii) [Another colleague suggests implementing the fixed-income arbitrage

strategy using a large long position and a large short position. Explain what this means

and whether this strategy is safer than using leverage (to implement a fixed income

arbitrage strategy)

(d) A hedge fund has the following fee structure:

Annual management fee based on year-end Assets Under Management (AUM):

2%

Incentive fee: 10%

Hurdle rate before incentive fee collection starts: 6%

Current high-water mark: $620 million

The fund has a value of $600 million at the beginning of the year. After one year, it has a

value of $730 million before fees. For this year, what is the net return to the investor?

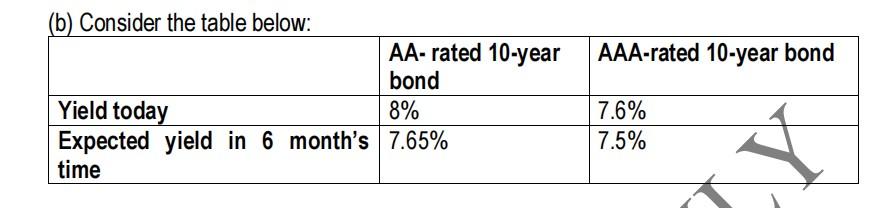

(b) Consider the table below: AA-rated 10-year bond Yield today 8% Expected yield in 6 month's 7.65% time AAA-rated 10-year bond 7.6% 7.5% Y (b) Consider the table below: AA-rated 10-year bond Yield today 8% Expected yield in 6 month's 7.65% time AAA-rated 10-year bond 7.6% 7.5% Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts