Question: QUESTION 4 Countries A , B and C are in same geographic location but are at different stages of economic development. Countries A and B

QUESTION

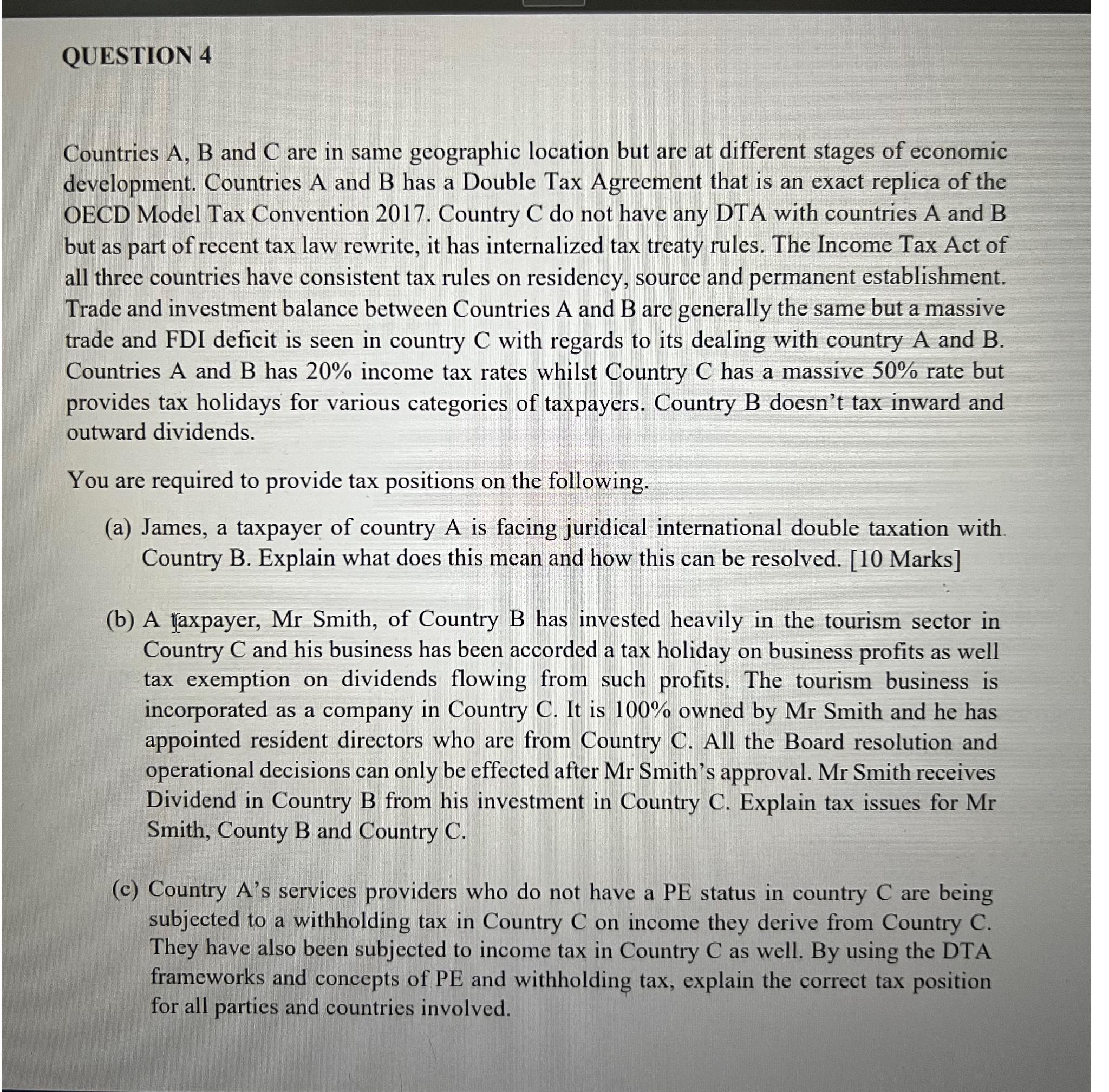

Countries A B and C are in same geographic location but are at different stages of economic development. Countries A and B has a Double Tax Agreement that is an exact replica of the OECD Model Tax Convention Country C do not have any DTA with countries A and B but as part of recent tax law rewrite, it has internalized tax treaty rules. The Income Tax Act of all three countries have consistent tax rules on residency, source and permanent establishment. Trade and investment balance between Countries A and B are generally the same but a massive trade and FDI deficit is seen in country C with regards to its dealing with country A and B Countries A and B has income tax rates whilst Country C has a massive rate but provides tax holidays for various categories of taxpayers. Country B doesn't tax inward and outward dividends.

You are required to provide tax positions on the following.

a James, a taxpayer of country A is facing juridical international double taxation with. Country B Explain what does this mean and how this can be resolved. Marks

b A taxpayer, Mr Smith, of Country B has invested heavily in the tourism sector in Country and his business has been accorded a tax holiday on business profits as well tax exemption on dividends flowing from such profits. The tourism business is incorporated as a company in Country C It is owned by Mr Smith and he has appointed resident directors who are from Country C All the Board resolution and operational decisions can only be effected after Mr Smith's approval. Mr Smith receives Dividend in Country B from his investment in Country C Explain tax issues for Smith, County B and Country C

c Country As services providers who do not have a PE status in country are being subjected to a withholding tax in Country on income they derive from Country They have also been subjected to income tax in Country as well. By using the DTA frameworks and concepts of and withholding tax, explain the correct tax position for all parties and countries involved.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock